This post is a follow up from our November 18th post, Time to buy Chicago Wheat

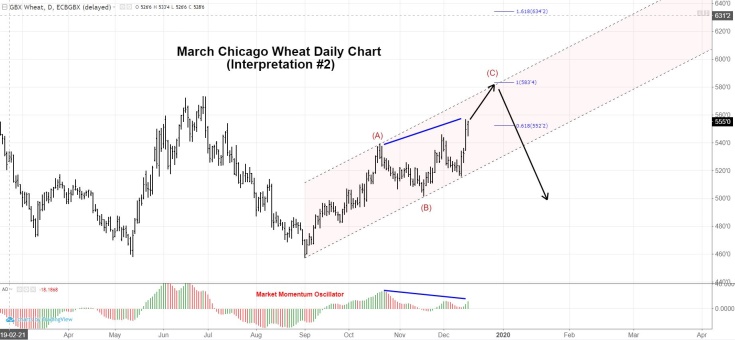

For buyers that did not take advantage to extend coverage in the 3-wave decline that followed an initial 5-wave rally, there may be more pain ahead. Below, is our current wave count on the daily chart.

- Prices appear to be moving impulsively higher as you would expect in a wave 3

- The Relative Strength Index is confirming that the overall trend is higher

- Note: In contrast, there is bearish divergence between price and momentum that may signal a reversal.

What we need to see for further confirmation that this forecast is correct and we can expect prices to trade much higher, north of $6.30, is the following:

- Prices accelerate through the red trend line drawn on top of the corrective price channel.

- Momentum to build such that there is not divergence and there is confirmation on strength of trend.

Below is an hourly chart mapping out the clear subdivisions of our interpretation. Remember, sharp 5-wave moves define a trend of one larger degree. Choppy 3-wave moves are counter-trend and will be completely retraced.

Because there is divergence between momentum and price, it forces you to re-evaluate and see if there is a different wave count that may be valid. Below, there is an alternate interpretation. Although it is not as bullish as our #1 interpretation (the more probable scenario), it still has prices moving up to $5.80 area. This move should also stay within the parallel lines. If we get multiple closing prices above the trend channel, this interpretation can be discarded and the probabilities shift even more in favor of interpretation #1.

Chicago Wheat Futures Market Fundamentals

- S. Wheat is getting price support from Argentina’s move to raise taxes on exports of farm products.

- A statement by the vice Ag minister of China that the new phase one would include wheat, corn and rice purchases by China got the wheat market fired up. Adding to that bullish news was wetness in European wheat areas, delaying seeding, and dryness in the Ukraine, which had some analysts touting a potential 10% drop in winter wheat planting there.

- Managed funds were short, especially in both Kansas City and Minneapolis, with Minneapolis said to be a new, record- large net-short of over 23,000 contracts last week.

- If China were to buy U.S. wheat, it would likely be HRW or HRS, the two classes containing the largest fund short positions.

- Wheat export inspections last week were 18.6 mb, with total inspections for the year, at 499 mb, now 16% above a year ago. Competition is expected to remain very formidable in the coming year, with Russian wheat export so far in 2019-20 just 19.6 million metric tons (mmt) — down almost 15% from a year ago at this time.

- There was more talk in the wheat market on Monday about the potential for another fall in U.S. winter wheat acres.