This post is a follow up from Cocoa Futures Technical Analysis.

December Cocoa Futures Posturing Move to the Upside

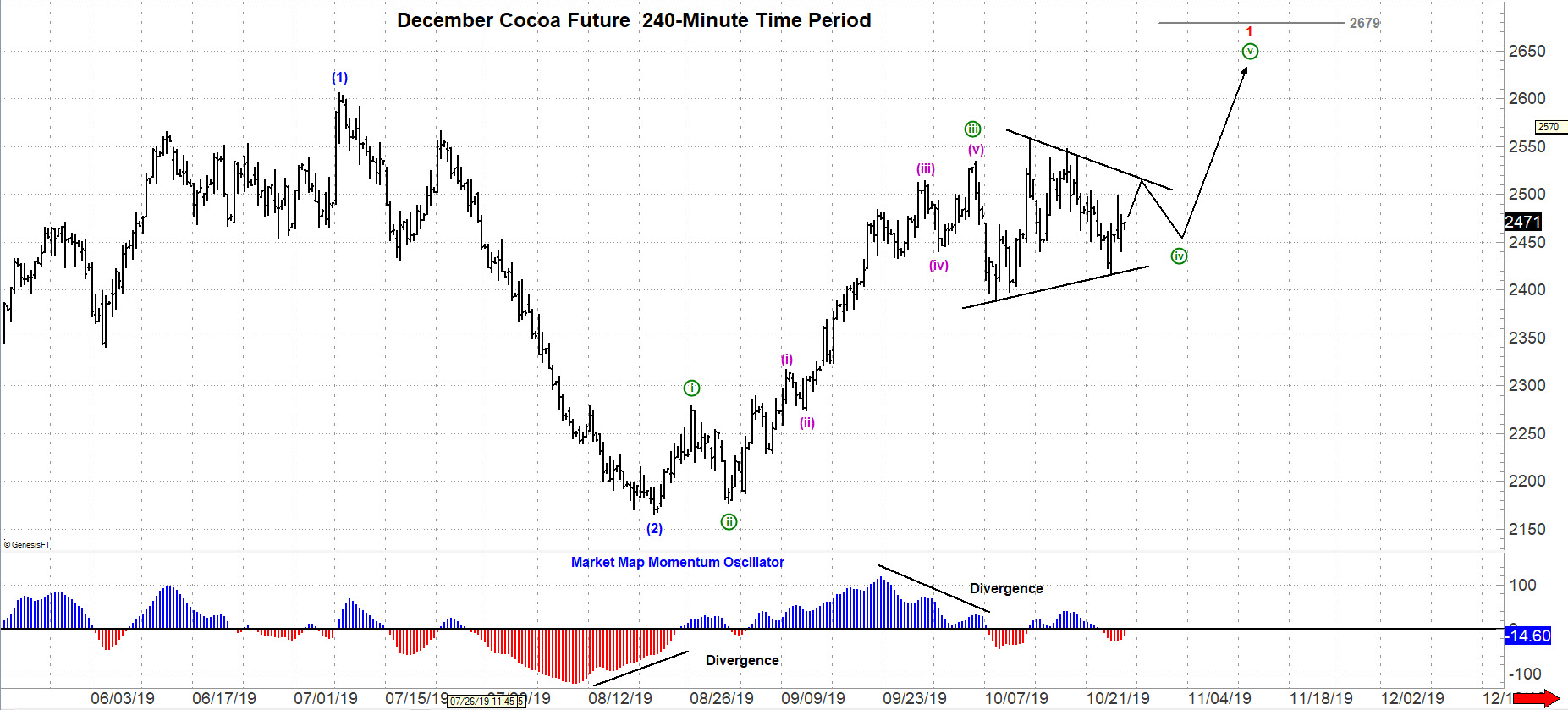

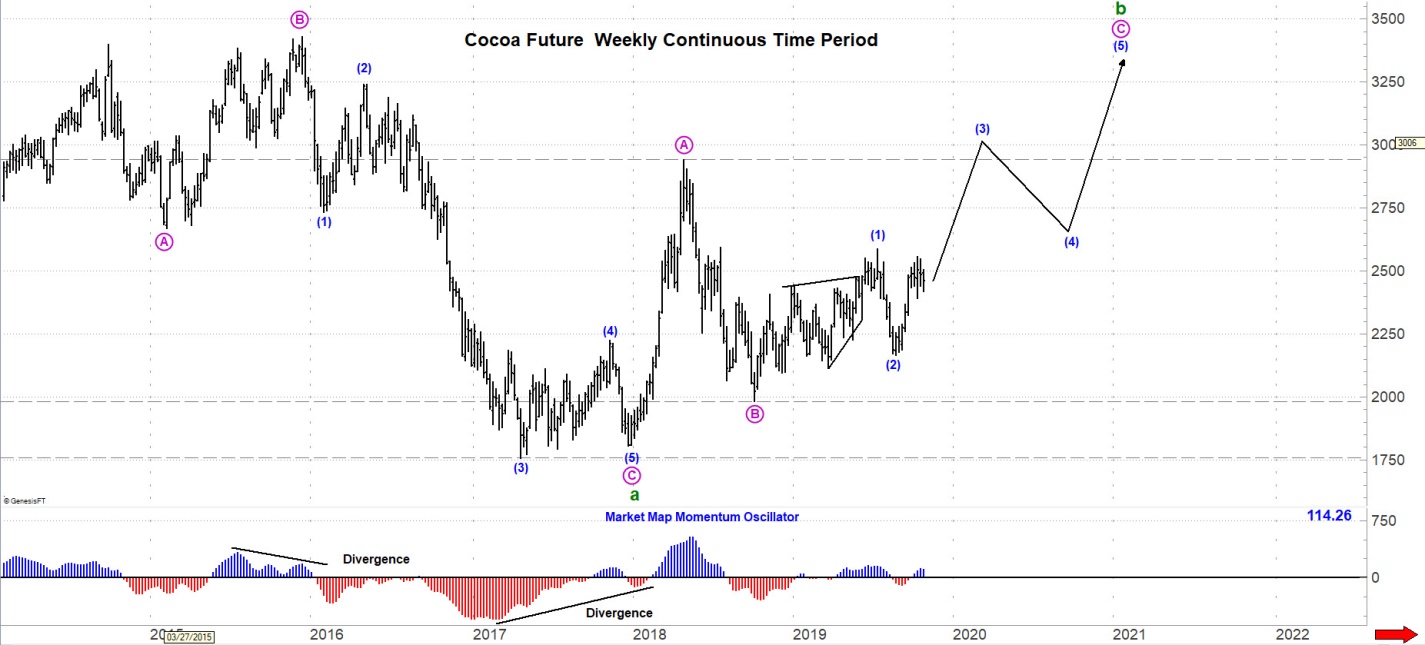

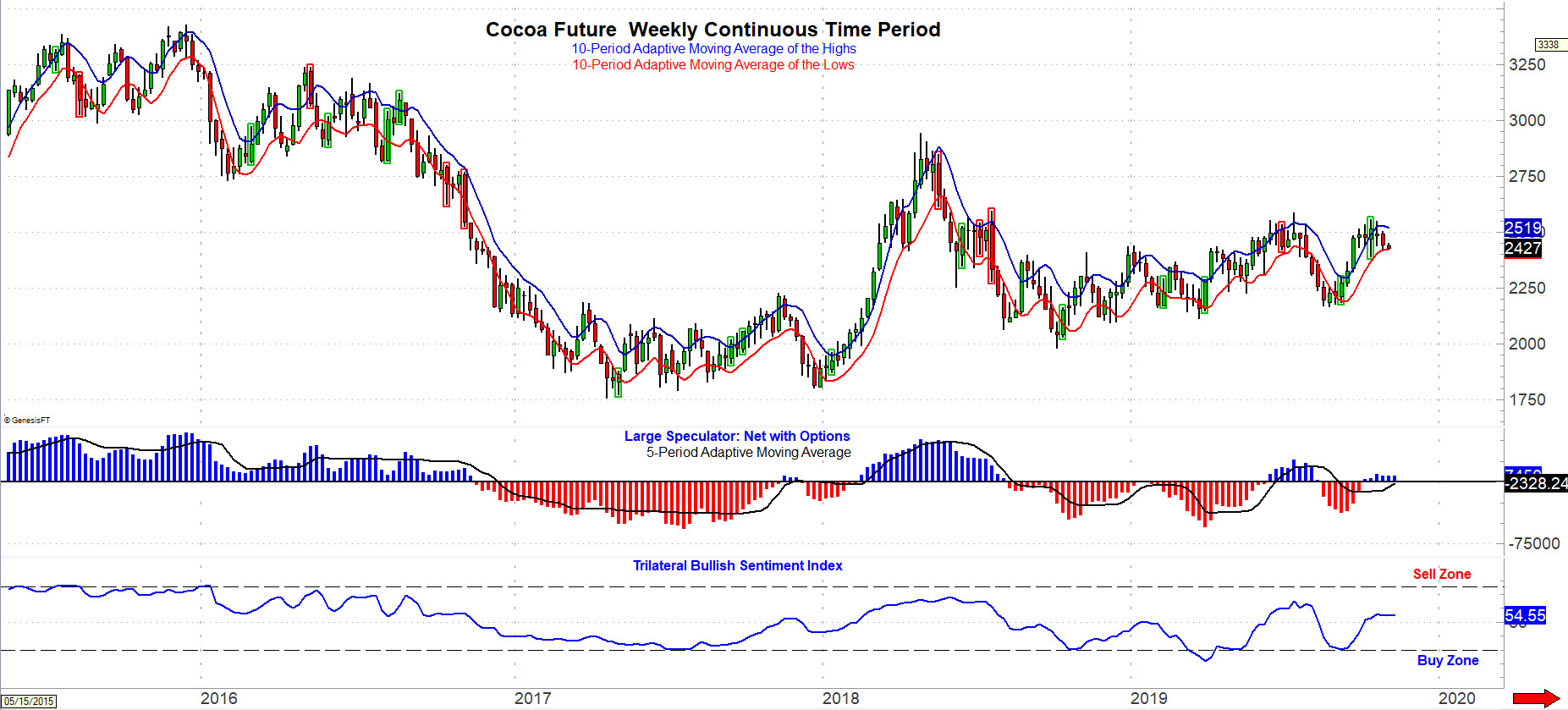

Cocoa has very choppy, trendless movement the past couple of weeks. Below is our outlook using 4-hour, daily, and weekly. Current price action appears to be that of a triangle. Note, triangles take time and mess up lots of traders trying to jump on the next breakout.

When triangles terminate, most traders are out of capital (financial and/or emotional) to take advantage of the subsequent vicious move, or exceptionally long extension. It should also be noted that triangles only occur in the second to last wave of a sequence. Applying that to Cocoa’s situation, if our wave count plays out, the subsequent rally will be the last up move for an intermediate time frame 3-6 months. Overall, trend is higher, so any retracements lower can be used to add coverage with confidence, if you are not comfortable with your current situation.

Fundamental Conditions in the Cocoa Market

December cocoa prices on Friday closed lower and finished the week down -2.05%. December New York cocoa fell to a 2-week low Wednesday on abundant cocoa supplies.

Monday’s data from the Ivory Coast showed that Ivory Coast farmers sent 69,864 metric tons (MT) of cocoa to ports during October 14th to the 20th, down -4.5% from the year-earlier period, although total arrivals for the season that began October 1st are 202,061 MT, up +14% from the year-earlier period.

The Ivory Coast reported October 14th that last year’s 2018/19 cocoa harvest was a record 2.248 million metric tons (MMT) (+14.5% year over year). Cocoa prices were also undercut by last week’s Q3 demand news. Q3 North American cocoa processing fell by -7.4% year over year to 119,004 MT, weaker than expectations of -1.0% year over year, and European Q3 cocoa processing fell -0.1% year over year to 362,940 MT, slightly weaker than expectations of unchanged. However, Q3 Asia cocoa processing bucked the trend and jumped by +14.7% year over year to a record 225,356 MT, stronger than expectations of +6.9% year over year.

A positive factor was Thursday’s data from Ghana, the world’s second-biggest cocoa producer, after the Ghana Cocoa Board reported that cocoa purchased from farmers from October 1st to 10th totaled 8,293 MT, far below the 40,657 MT of cocoa purchased the same time last year.