Multiple Elliott Wave Interpretations?

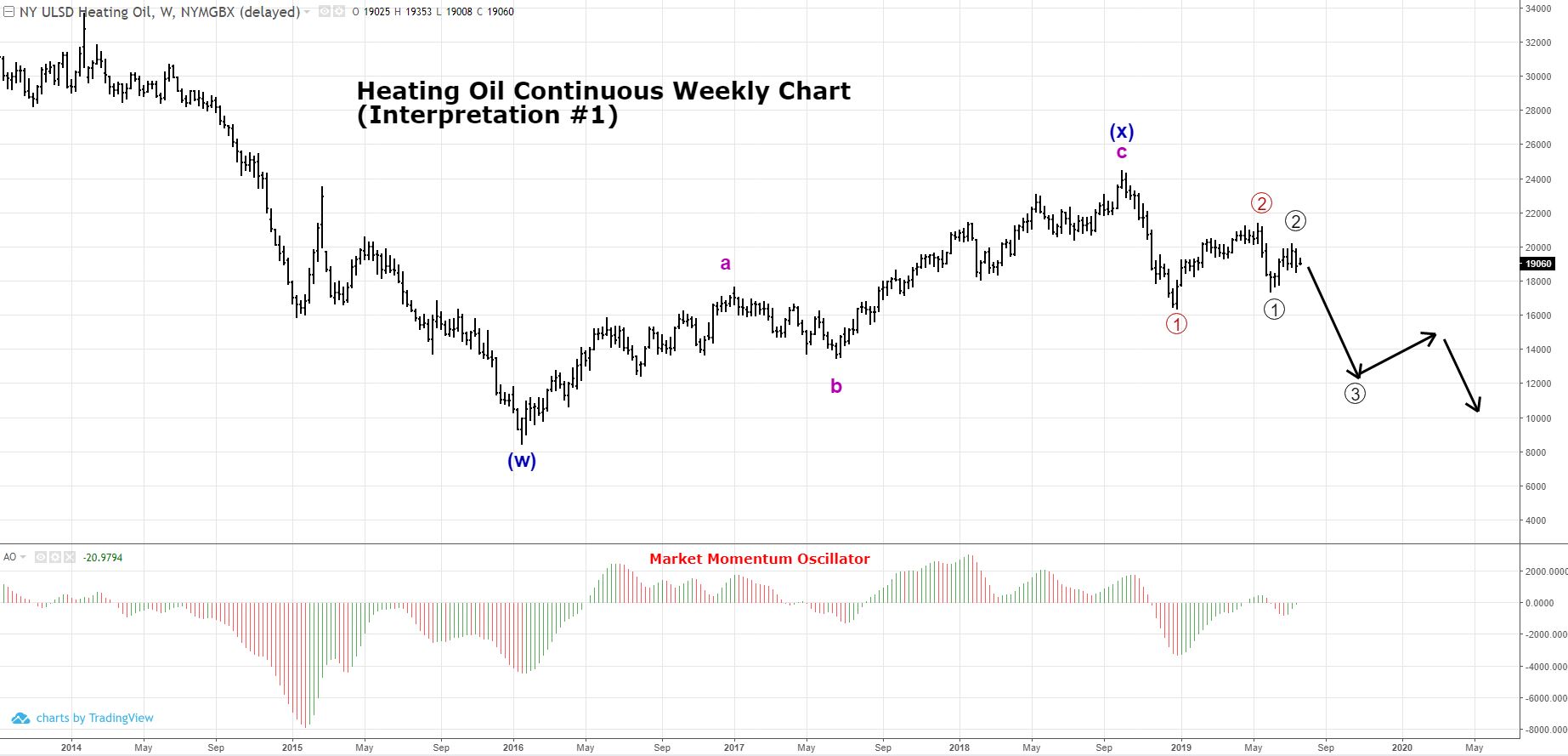

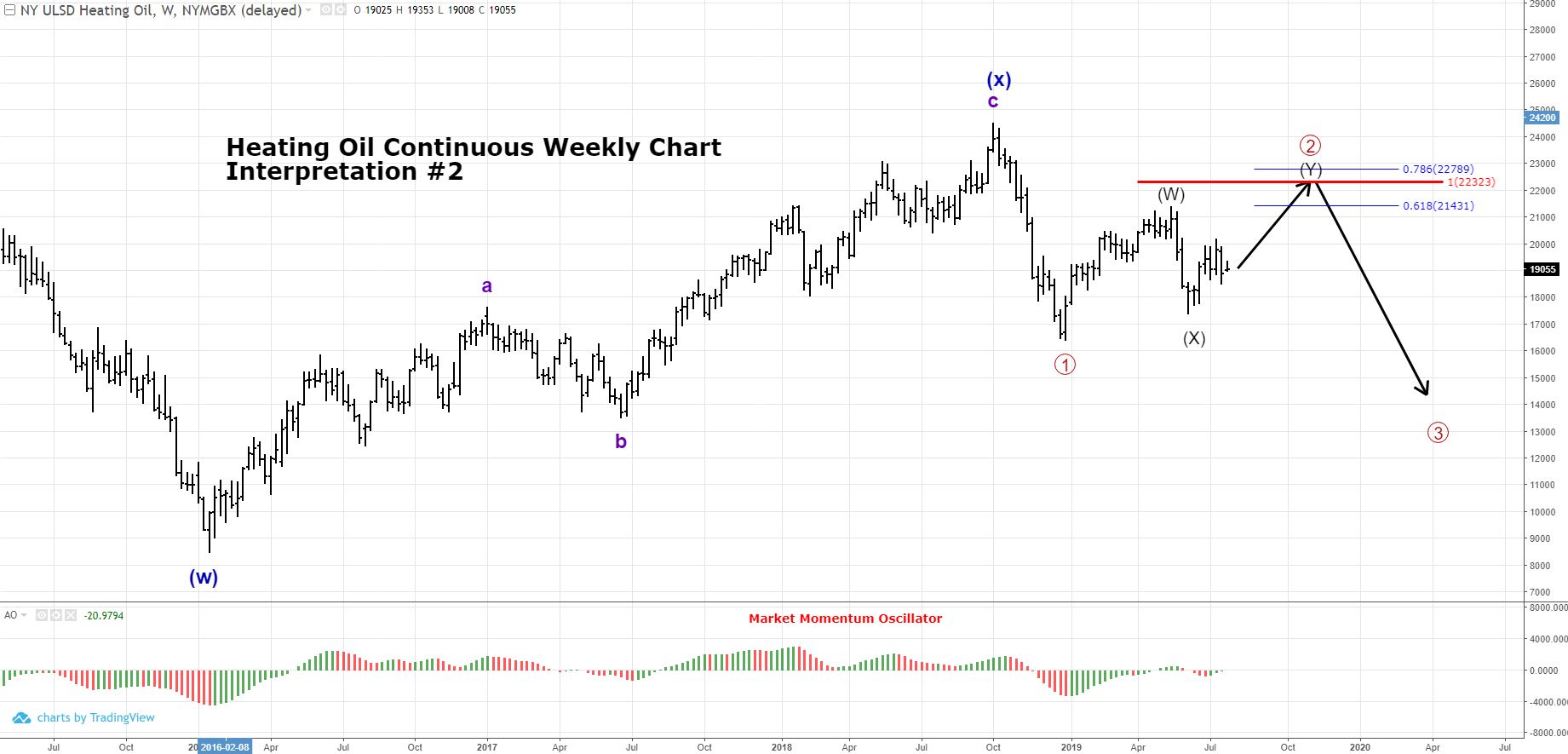

Two Valid Interpretations in heating oil make it difficult to dig your heels in and take larger position (opinion). However, waiting for a new price extreme (high or low) and applying the rules and guidelines of Elliott Wave Theory can allow one to adjust the wave count and assign probabilities to each potential outcome. It is with these probabilities where one can make a decision toward trading or procuring. Currently, I would put a 60% probability the #1 Interpretation is correct; a 30% probability on #2 Interpretation being correct, and a 10% probability a different wave count will reveal itself.

It is with new price action and the statistics from market studies that we can become more emboldened in any one interpretation.

We will revisit this market as it gives us new information to illustrate how a wave count is constructed, considered, adjusted, and traded. This can give a buyer the idea of how to minimize risk while trying to maximize margins.

Until then…..

Case for lower prices ($11.60-$1.70):

- Momentum suggest we should make another new low on less momentum

- Slope analysis suggests the downtrends are stronger than uptrends; this signals downtrend is still intact. Need an uptrend with strong slope to negate the downside pressure.

- This has been the interpretation we have been following and it has behaved and heeded benefits. This increases the probability it is the correct one

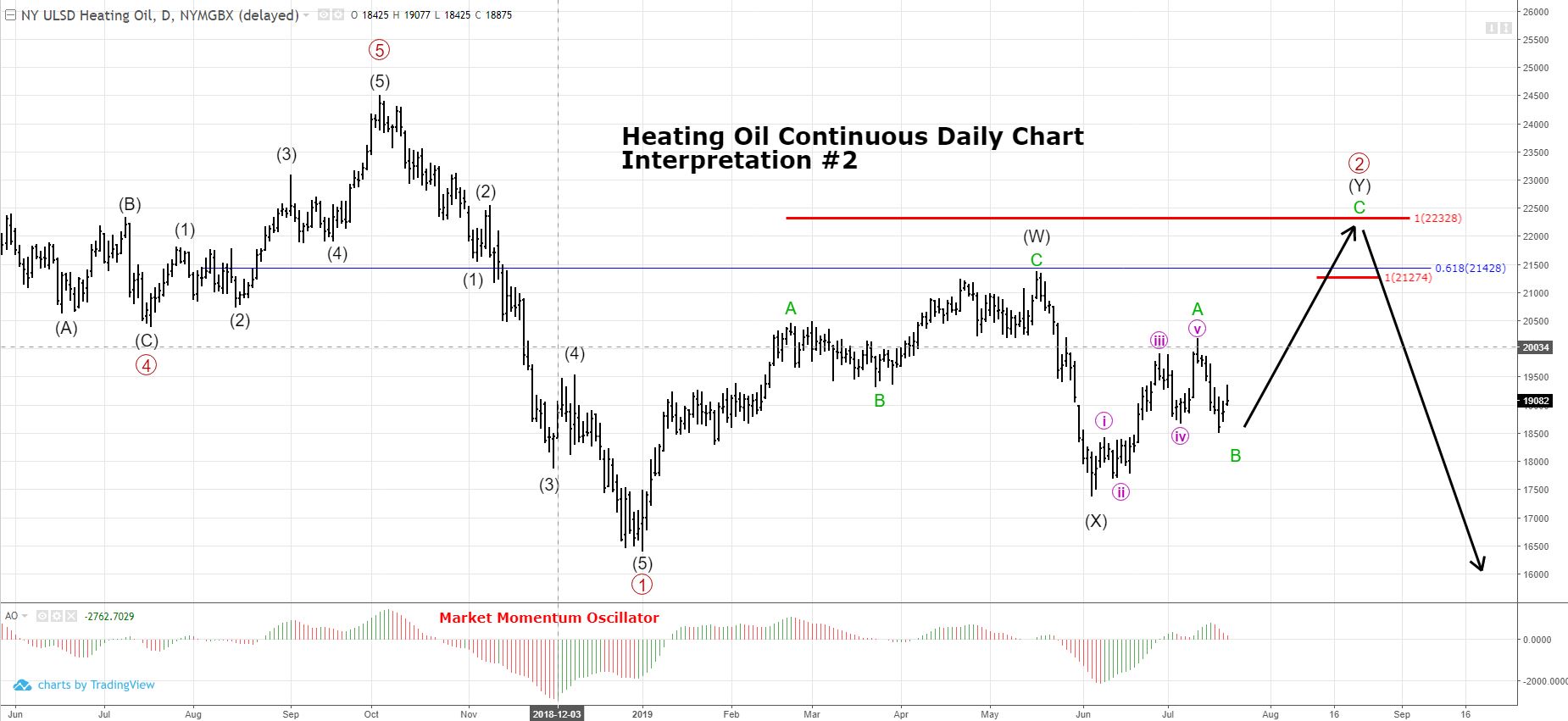

Case for higher prices (Back up to $2.15-$2.25):

- We have a 5-wave move off the low made in early June. This implies we should get another new high because the only patterns that have 5-wave initial moves are impulses, leading diagonals (rare) and zig-zags. They all call for another price extreme to the upside.

- We have not seen momentum divergence on the daily chart to signal a completion of counter-trend move.