October Live Cattle Moving Lower?

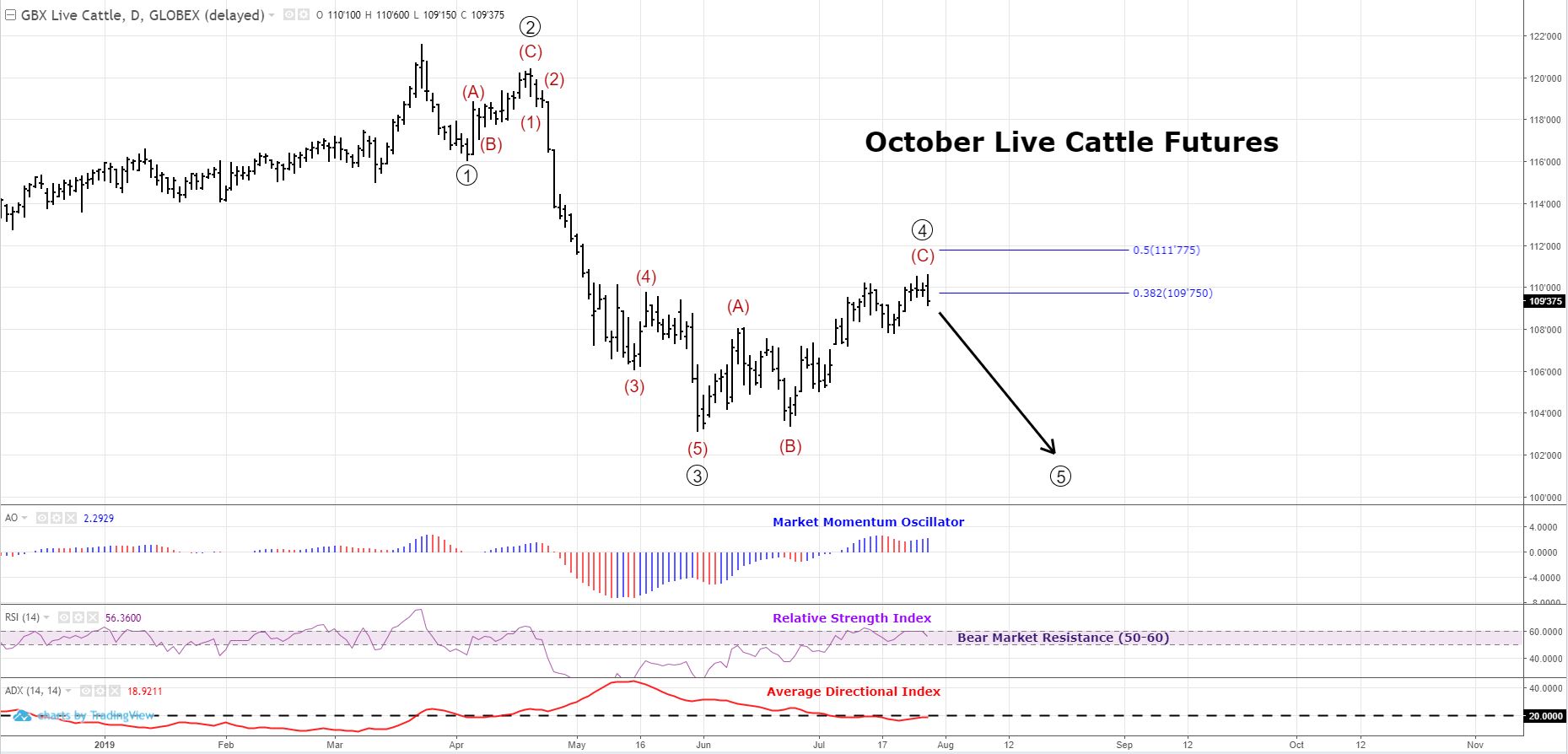

I have switched to October. I am thinking that wave Wave (C) of 4 is near completion and the we may be starting Wave 5 down this week; however, we have no real price confimation to get very excited about. Supportive evidence for this interpretation is the fact that projected Wave 4 retraced near exactly 38.2% of Wave 3 (common for wave 4’s). Subwave (C) is 1.382% of Subwave (A); a common target for (A)-(B)-(C) expanded flats. Bear Market resistance of 60 in RSI has so far held, indicating the overall trend is still lower.

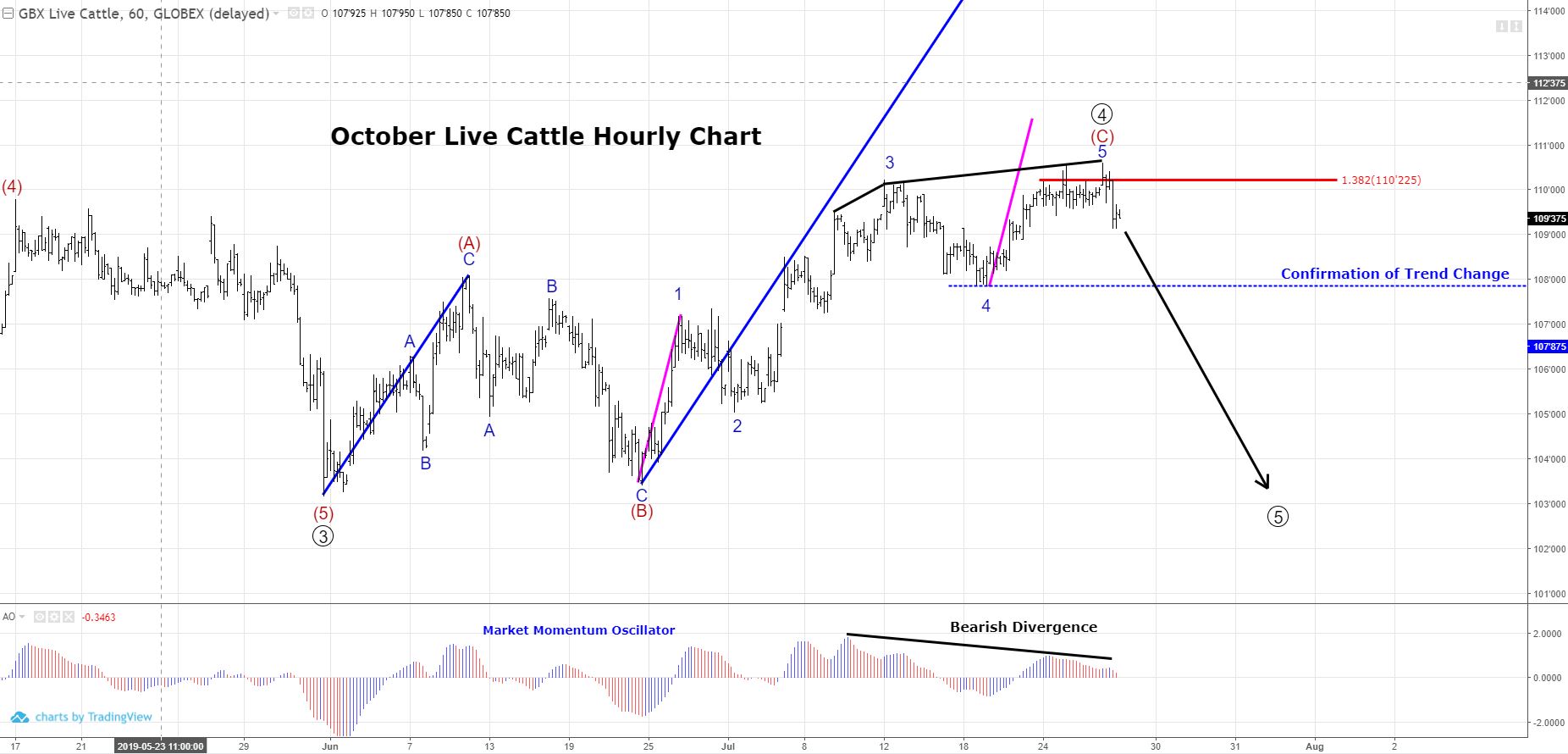

In addition, slope analysis suggest the counter-trend rally is tiring. Wave (C) of wave 4 has a flatter slope than Wave (A) of 4. This is indicative of a slowing trend, tiring out. If most recent price action was that of a wave 3 higher (bullish outlook), this slope “should” be steeper. Also, on the hourly chart, subdivision Wave 1 of (C) has a steeper slope than wave 5 of (C), also an indication of a tiring trend.

Further evidence for the interpretation and outlook includes:

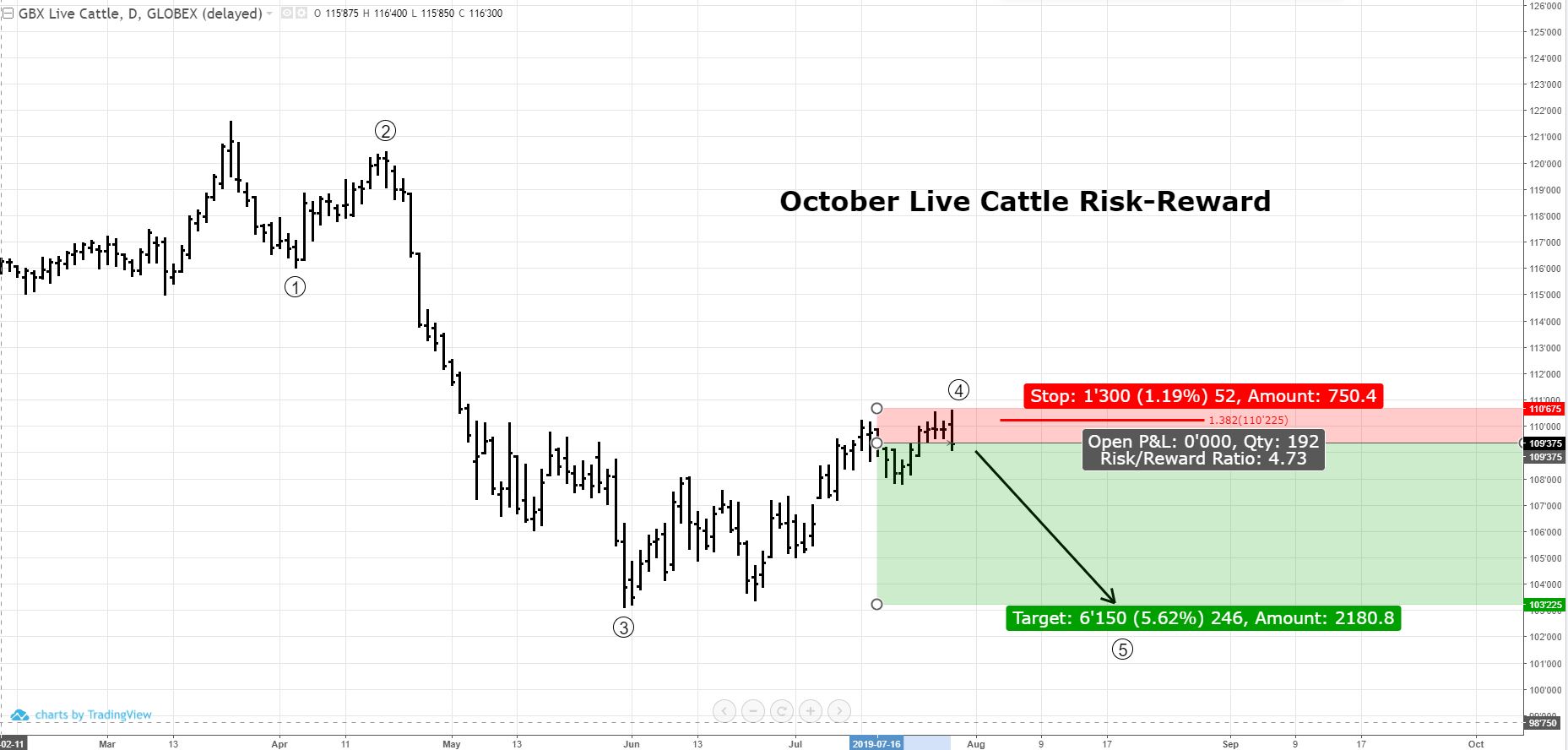

On the hourly chart (above), subdivisions are easy to count and we had bearish divergence at the perceived top made the previous week. Confidence will build with this forecast if prices can take out the previous swing lows near $107.00 and $105.80, especially if those declines trace out 5 subwaves. With Wave 3 extended, it would prudent to expect Wave 5 to take the form of an ending diagonal (a sharp, 5-wave move that usually subdivides into 3-3-3-3-3). Expectations are for lower prices below $100, perhaps testing $98.00. It should be noted that once 5 countable subwaves of Wave 5 appear, all the requirements will be met for a completed wave pattern at this degree. Thus, one should not be surprised for the major counter-trend move to take place as a wave 2 or wave B. That counter-trend move will last 2-3 months and typically retrace 50% of wave 1 or A. That being said, it will be important to monitor momentum and other indicators before trying to pick a bottom. The safest way is to count a 5-wave rally then a 3-wave decline. Critical resistance for this current interpretation is $110.25. Two Closing prices above this level would most likely call for a different wave count.