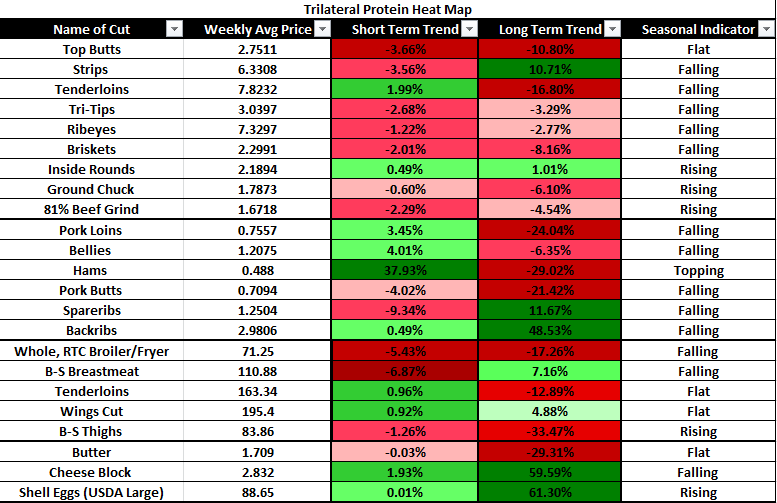

Take Aggressive Buying Stance:

- Beef Tenderloins

- Chicken Thighs

- Butter

Take a Passive Buying Stance:

- Strip Steaks

- Pork Ribs

- Cheese

Boxed Beef: Prices for the Choice boxed beef cutout averaged $201.24/cwt. $3.29 lower for the week. Meanwhile, Selects settled at $191.14/cwt, a decline of $4.55. While cutout values were lower, buyers were more aggressive in both spot and forward markets than seen in some time.

Looking into August, school purchasing programs typically provide support. This year may be a bit different depending on the government and school board repsonses to COVID. Come mid-Fall, beef supplies usually move lower and demand will start to perk up for holiday purchasing.

Expectations are for softer prices next week, but prices are currently at levels not seen in years. Moreover, we are entering the zone of annual lows. Consequently, buyers should not be complacent.

(Reuters) China Floods Blamed For Fresh African Swine Fever Outbreaks – Price Back Near Highs: Outbreaks of deadly African Swine Fever are surging in some parts of Southern China following heavy rains according to analysts and industry sources. This could be a major setback for Beijing’s goal of replenishing pork supplies. China’s hog herd, by far the world’s largest, shrank last year by around 180 million pigs. Roughly a 40% decline after the incurable disease decimated farms.

Pig producers are buying new farms and restocking amid the push to restore lost pork production and tame runaway meat prices. But, while ASF outbreaks have declined, the disease remains an obstacle to herd recovery.

Heavy rains and flooding across China’s south since mid-June appear to have triggered fresh cases, according to Zheng Lili, Chief Analyst with consultancy Shandong Yongyi. A Shandong Yonhyi survey of small pig farmers, corporate farmers, traders and slaighterhouse in 20 provinces revealed dozens of ASF cases had occurred since the heavy rains in Guangdong province, the Guangxi region, and other areas. “If heavy rains continue throughout July, pig inventories in places like Sichuan, Guangdong, Guangxi, and Jiangxi, could fall as much as 20% by August from May,” Zheng said.

Live hog prices in the south have surged, with prices in Guangdong hitting 41.6 yuan ($5.96) per kg. on Thursday, just shy of a record of 43 yuan set last October.

USDA Monthly Livestock, Dairy, and Poultry Outlook: May broiler production came in higher than expected at 3.6 billion pounds, a year-over-year increase of 2.2% (adjusted for slaughter days). This increase was driven largely by average live-bird weights, which reached a record 6.45 pounds (2.0% higher year-over-year), while slaughter increased by 0.2% (adjusted for slaughter days).

Preliminary weekly slaughter data imply that the increase in May bird weights was driven by higher weights in both small (6.25 lbs. and below) and large bird (6.26 lbs. and above) weight categories, as well as an increase in the proportion of large-bird production. It is possible that the increase in bird weights reflected the disruptions in the processing sector.

The year-over-year increase in slaughter – albeit slight – points to the ability of the broiler industry to recover quickly. Based on higher-than-expected May production, the second-quarter production forecast was increased to 10.900 billion pounds.

In May and June, eggs set and chick placements recovered from April lows and increased beyond year-earlier levels. This points to improved producer expectations as well as more birds available for slaughter in the coming months.

Based on expectations for higher slaughter, the second-half production forecast was increased to 22.500 billion pounds. The 2020 chicken production forecast is 44.637 billion pounds, about 2% higher than 2019 production.