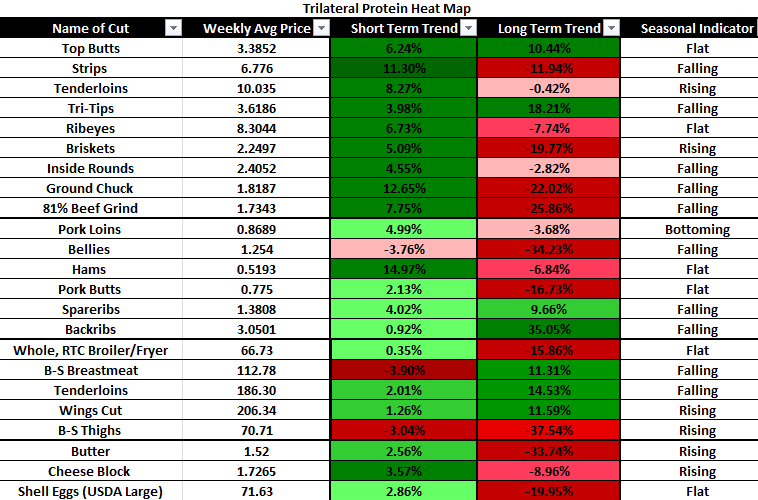

Purchase Aggressively

- Briskets

- Beef Tenderloins

- Pork Butts & Loins

- Eggs

- Butter

Purchase Passively

- Top Butts

- Tri-Tips

- Pork Ribs

- Chicken Wings

Protein Market Commentary:

CASH: Last week, trade in the North occurred mostly at $106 live and $169 dressed. This was steady to $1 higher from the previous week. The volume of cattle moved was considered moderate. In the South, cash cattle traded at $106-$107, mostly $2 higher week over week. Feeder cattle exchanged hands at levels steady to $4 higher. Calves were mixed, ranging from $2 lower to $3 higher and market cows had weaker tone.

BOXED BEEF: Prices for the choice boxed beef cutout averaged $222.90/cwt, up $12.99 for the week, while Selects at $205.72/cwt, a gain of $9.40. Strong sales for Labor Day, and at least some small transactions for school supplies were all market supports. Schools who are opening buy only short-term requirements, but the additional purchase helps the cutout values rise. Looking into next week, prices are expected to find a short-term high as Labor Day purchasing wraps up, and the lack of spectator sporting events takes away from a typical fall purchasing program. Trimmings and end cuts will be affected most.

CATTLE ON FEED: Cattle and calves on feed for the slaughter market in the U.S. for feedlots with capacity of 1,000 or more head totaled 11.3 million head on August 1, 2020. The inventory was 2% above August 1, 2019. This is the highest August 1st inventory since the series began in 1996. Placements in feedlots during July totaled 1.89 million head, 11% above 2019. Net placements were 1.84 million head. During July, placements of cattle and calves weighing less than 600 pounds were 420,000 head, 600-699 pounds were 315,000 head, 700-799 pounds were 435,000 head, 800-899 pounds were 458,000 head, 900-999 pounds were 195,000 head, and 1,000+ pounds were 70,000 head. Marketings of fed cattle during July totaled 1.99 million head, 1% below 2019. Other disappearance totaled 57,000 head during July, 20% below 2019. The monthly cattle on feed report was considered bearish. Hot dry weather in much of the country pushed cattle to the feed yards in July possibly lightening the number of cattle to come this fall. Placements garnered the attention with the actual number of 111% well over the pre-release guesses of 106. Futures traders sensed a surprise and sold futures the past two days in anticipation of a disappointing report.

(USDA) DECREASING PROCESSOR MARGIN PROMPTS THIRD-QUARTER PRODUCTION FORECAST REDUCTION: While weekly gross pork processing spreads remain above a year ago, prospects of continued moderate wholesale demand for already-large weekly pork supplies are likely to limit incentives for processors to run plants to achieve higher weekly slaughter numbers than those seen so far this summer. Higher hog prices as slaughter rates increased and continued large pork supplies affecting wholesale prices have pressured processing margins. Processor margins are likely to stabilize as more-than-ample hog supplies achieve market weights and begin to pressure hog prices, but these margins will likely limit incentives to increase slaughter. Consequently, third-quarter pork production is lowered to 7.2 billion pounds, slightly smaller than last month’s forecast, prompted by a likely continuation of July’s lower-than-expected rate of weekly slaughter for the balance of the quarter. Moreover, average dressed weights are likely to be lower for the rest of the year, given the prevalence of slow-growth hog rations and the absence of ractopamine in such rations. Prices of live 51-52% lean hogs are expected to average $36 per cwt in the third quarter and $35 in the fourth quarter. These price forecasts are lower than last month, due to prospects of large supplies of slaughter-ready hogs coupled with just-moderate demand for hogs at the packer level, deriving from moderate wholesale pork demand.

(REUTERS): China imported 430,000 tonnes of pork in July, customs data showed late on Sunday, up 136% from the same month a year earlier and a record monthly volume, despite tough new checks on cargoes that had slowed clearing at ports. Chinese importers have been bringing in huge volumes of meat this year to fill a large domestic supply shortage after an epidemic of African swine fever killed millions of pigs in China. July imports were even larger than June’s 400,000 tonnes, which had been the highest ever, along with the same amount in April. The huge imports came even after China started testing containers of frozen food for the presence of the novel coronavirus in June, which had slowed the clearing of meat cargoes at ports through July. China has also asked overseas plants to suspend shipments if they experience coronavirus cases among workers. Work at dozens of plants has been temporarily suspended, even though most experts say there is no evidence to show the virus can be transmitted through food. January to July pork imports reached 2.56 million tonnes, up from just over 1 million tonnes a year ago. Imports of pork including offal in July came to 560,000 tonnes, bringing total imports for this year to end-July to 3.38 million tonnes, the data also showed. Beef imports in July came to 210,000 tonnes, said customs, with shipments for the first seven months reaching 1.2 million tonnes.

(USDA): In their monthly Chicken & Eggs report, United States egg production totaled 9.27 billion during July 2020, down 2% from last year. Production included 8.01 billion table eggs, and 1.25 billion hatching eggs, of which 1.17 billion were broiler-type and 83.2 million were egg-type. The average number of layers during July 2020 totaled 279 million, down 3% from last year. July egg production per 100 layers was 2,445 eggs, up 1% from July 2019. Total layers in the United States on August 1, 2020 totaled 378 million, down 4% from last year. The 378 million layers consisted of 314 million layers of producing table or market type eggs, 60.6 million layers producing broiler-type hatching eggs, and 3.30 million layers producing egg-type hatching eggs. Rate of lay per day on August 1, 2020, averaged 79.7 eggs per 100 layers, up 2% from August 1, 2019.