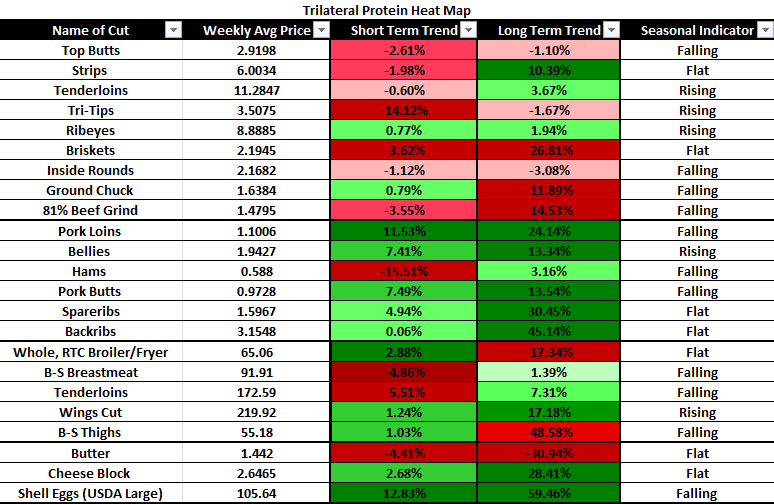

Take Aggressive Purchasing Stance:

- Beef Grinds

- Beef Tenderloins

- Chicken Thighs

- Butter

Take Passive Purchasing Stance:

- Ribs

- Hams

- Wings

- Cheese

Boxed Beef:

Prices for the Choice boxed beef cutout averaged $2.1604/cwt, down $2.06 for the week. On the other hand, Selects settled $204.67/cwt.

Last week, buyers saw the huge volume of beef production and were content to let sellers come to them in order to transfer the adequate supply of beef. Buyers were reluctant to dive in, noting the wide deals, which resulted in a largely sideways trade.

Looking into next week, production may moderate, but will remain strong. Holiday demand is still a week or two away, and warm temperatures are slowing demand for roasting products in most of the world. Looking further ahead, prices will be supported by holiday buying that could increase the value of the cutout, especially in the primals of the rib and loin.

(USDA) Livestock & Poultry (World Markets & Trade) Report:

Global production is forecast nearly 2 percent higher in 2021 as an improving global economy and industry responses to support a production recovery.

Global exports in 2021 are expected to grow 3 percent as better economic conditions and food service recovery support demand. U.S. production for 2021 is forecast up 1 percent on higher slaughter and heavier carcass weights. Exports are expected to grow 6 percent, primarily on higher shipments to East Asia. Lower exports by Australia, a major supplier to many markets in the region, are expected to reduce competition. During 2021, the United States is expected to become the second largest exporter globally, overtaking Australia and India, but remaining well behind Brazil.

For pork, global production is forecast 4 percent higher in 2021 due to rebounding output in countries affected by African Swine Fever (ASF), and to a lesser extent, recovery from COVID-19 impacts.

Global exports are forecast unchanged at 10.8 million tons in 2021. Global pork demand is expected to rebound from COVID-19 on improving economic conditions and recovery in the restaurant and food service sectors.

U.S. production is forecast about 1 percent higher in 2021 on modest growth in slaughter. Producers indicated intentions to reduce sow farrowings in later 2020, and first quarter of 2021. This will limit hog supplies much of next year while slightly lower carcass weights will also limit production growth. Despite a relatively strong domestic market, export demand is softening. Exports are unchanged from 2020 at 3.3 million tons, as weakening demand from China offsets growth to other markets including Mexico and Japan.

Germany Finds Ten New ASF Cases, Total 65 Now:

Ten more cases of African Swine Fever have been confirmed in wild boars in the eastern German state of Brandenburg, according to Germany’s agriculture ministry on Monday.

The new discoveries bring the total number of confirmed cases to 65 since the first one on September 10th. All were in wild animals with no farm pigs affected, it said. Germany’s Freidrich-Loeffler scientific institute had confirmed the latest animals had African Swine Fever, the ministry said.

All were found in the area around the first discoveries. China and a number of other pork buyers banned imports of German pork in September after the first case was confirmed, causing Chinese pork prices to surge.

China Finds African Swine Fever In Piglets In Chongqing:

China’s agriculture ministry confirmed ASF in piglets illegally transported to the southwestern city of Chongqing on Friday. The first reported outbreak since July 25th. The Chongqing Animal Disease Prevention and Control Center seized 70 piglets of which two were dead, and 14 were ill, the Ministry of Agriculture and Rural Affairs said in a statement.

(USDA WASDE):

USDA on Friday released its October Crop Production and World Agriculture Supply and Demand Expectations (WASDE) reports.

USDA lowered ending stocks for the 2020-21 marketing year to 290 million bushels (mb), a 170 mb decline from September that was just slightly above the lowest pre-report estimate. USDA also trimmed production forecasts by 35 mb, lowered beginning stocks by 52 mb and increased exports by 75 mb.

Friday’s new U.S. ending stocks estimates were neutral for corn and wheat, bullish for soybeans, while the world ending stocks estimates were neutral for corn, bullish for soybeans, and bearish for wheat.

With ending stocks at 2.167 bb, that dropped the stocks-to-use ratio for corn down 14.8%, compared to 17% just a month ago. The average farm price for the 2020-21 corn crop was pegged at $3.60 a bushel, a dime above last month’s estimate. The national average farm-gate price, at $9.80, is 55 cents higher than last month’s forecast.

Egg News:

The U.S. flock in production was up 0.6 million from the previous week to 312.2 million, with molted hens resuming production and pullets reaching maturity. Shell inventory was down 2.6 percent after a 3.7 percent increase last week indicating restoration of balance between demand and supply. There is some evidence of a return in the food service sector as the economy cautiously reopens but the incidence rate of COVID-19 increasing in some regions.