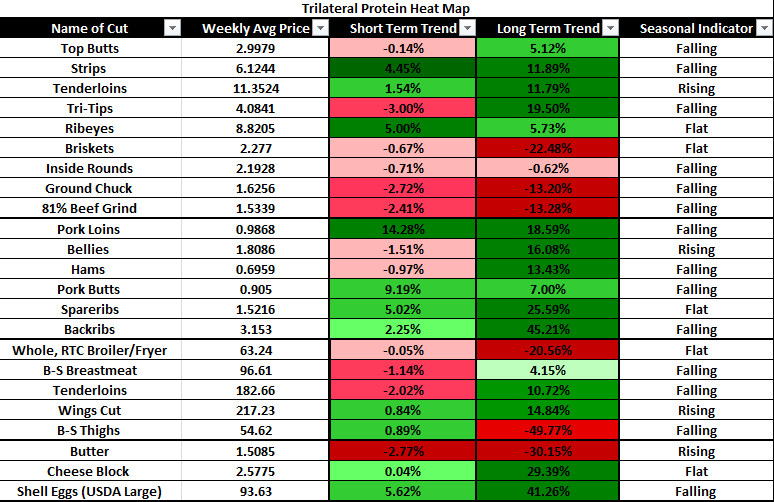

Take Aggressive Purchasing Stance

- Beef Grinds

- Tenderloins

- Chicken Thighs

- Butter

Take Passive Purchasing Stance

- Tri-Tips

- Pork Ribs

- Wings

- Cheese

Cash Cattle:

Texas led prices up to $108 this week. Most other regions have sold the bulk of cattle at $107 live and $167 dressed. Many sellers in both areas are holding additional cattle offered at $108-$110.

Feeder cattle were mixed, from $2 lower to $3 higher. Calves ranged from $3 lower to $4 higher. Market Cows were mostly $1 to $4 lower on the week.

The mixture of more than ample slaughter and tighter placed against has resulted in a more manageable front-end supply. Expectations are for this trend to continue over the next 60 days and should result in a shift of leverage that will enable the cash market to move higher. Price optimists believe prices will remain firm ($108-$109) next week, and perhaps trade in the range of $108-$113 in the next month, citing the beef market’s seasonal tendency to rise and the ample margins available within the industry.

Boxed Beef:

Prices for the Choice boxed beef cutout averaged $2.1810/cwt, up $1.23 for the week. Meanwhile, Selects settled $207.24/cwt, an increase of 35 cents.

many industry participants believe prices may have put in a seasonal low last week, which is a bit earlier than typical (second week of October). This illustrates how strong beef demand has been. Especially given the massive COVID related shutdowns in the foodservice industry. This gives optimism to many on fourth quarter prospects with the holidays on deck.

Next week, expectations are that asking prices will move higher and buyers will abide – supporting the cutout value. October is national pork month, so gains will probably be limited as pork should be in the majority of the features.

Looking further ahead, holiday purchasing will carry and potentially move boxed beef higher in the fourth quarter, especially in the rib and loin primals.

(USDA) Quarterly Grain Stocks Report:

USDA on Wednesday released its September 1st Grain Stocks and Small Grains Summary reports. USDA’s Grain Stocks report found lower than anticipated supplies of corn and soybeans at the end of the marketing year, with the U.S. having 2 billion bushels (bb) of corn and 523 million bushels (mb) of soybeans on hand. It also made adjustments to production for both crops in 2019.

Wednesday’s Grain Stocks report was bullish for corn and soybeans, neutral for wheat. Meanwhile, the updated wheat production estimates are neutral for wheat in general, but slightly bullish for hard red winter (HRW) and soft red winter (SRW) wheat prices.

German Finds More ASF Cases, One In New Area:

Two more cases of African Swine Fever (ASF) were confirmed in wild boars in the Eastern German state of Brandunburg, with one found outside the area of the first discoveries, the federal agriculture ministry said on Wednesday.

One new discovery was confirmed in the Maerkish-Oderland district of Brandenburg outside of the area further south where the first cases were found, according to the ministry. The sites are about 60 kilometers apart. The second case was inside the original area, it added.

The incidents are regarded as separate outbreaks, said Brandenburg state health minister, Ursula Nonnemacher. Last year, Brandenburg built temporary fences along the border in an attempt to prevent wild boars entering the country from Poland, where the disease is common in wild animals.

The new discoveries bring total confirmed cases to 49 since the first on September 10th. All were in wild animals with no farm pigs affected, the federal ministry said. More wild boar cases must have been expected as the disease is highly infectious, it said.

China and other pork buyers banned imports of German pork in September after the first case was confirmed.

(Rabobank):

Moving through Q4 2020 and into 2021, the global poultry industry will operate in a volatile market context, with pressure coming from foodservice and wholesale markets.

Possible new waves of COVID-19 will add to the market ups and downs, and the impact of a deep economic crisis will make markets more more price-driven.

“Over the whole year, we expect a slight increase in global poultry production, mostly as a result of poultry expansion in China and Vietnam, where African Swine Fever reduced pork availability, and also from expansion in the U.S. The rest of the world will be operating in an environment of shrinking production.”, according to Nan-Dirk Mulder, Senior Analyst – Animal Protein.

Global trade has become difficult, with most import markets reducing volumes. Trade into ASF-affected markets like China, the Philippines, and Vietnam has become more important, and this raises risks as local production recovers. Exporters like Brazil, the U.S., and Russia are focused on China with export volumes expanding quickly, but with price concessions.