The Growing Role of Managed Money

HRS futures established a new record of net short managed fund positions in the latest CFTC Commitments of Traders Report of 16,586 contracts, which represented 27% of total open interest.

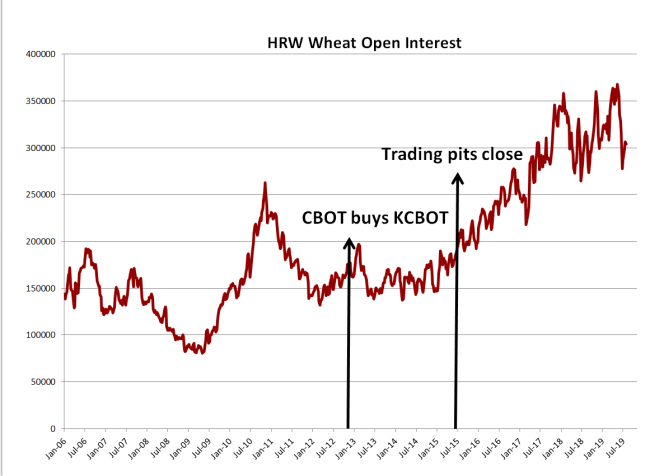

Before considering the fundamental supply and demand factors provided the catalyst for that record, it is perhaps worth noting what has facilitated managed money’s growing interest in previously “ignored” contracts. We believe it is due primarily to electronic trading providing more efficacious access to the markets. The chart of HRW open interest below is another example of a previously relative minor futures contract garnering increased trading activity and attention from managed money. It shows the steady rise in KCBT HRW futures total open interest after moving to an electronic trading platform. Moreover, a comparison of the first six months of 2016 to this year shows an approximate 270% increase in total managed money open interest. Going forward, funds may play a larger role in this market.

Looking at the Fundamentals

So armed with the ability for funds to better express their market sentiment via electronic trading, the record bearish position is attributable to a number of supply and demand factors:

- Perhaps the primary bearish factor is the near burdensome projected ending stocks for both world and domestic markets. The most recent USDA world supply and demand report forecast world ending stocks at a record large level of 286.5 million metric tonnes. US ending stocks have been lowered from previous record highs, but are still forecast to be at a burdensome and psychologically bearish threshold of one billion bushels.

- For HRS specifically, the USDA is projecting a 22% year-over-year increase in HRS ending stocks, the highest since 1987/88. That, coupled with relatively weak dependence for higher protein HRS wheat for blending purposed, bodes bearishly for HRS wheat. HRS demand is weakened, even with the drop in the average protein level in HRW wheat this year, by large stocks of high quality and high protein HRW in storage.

- The tariff war between the US and China has contributed to the destruction export demand from China. The damage in that regard has been more to soybean exports and to a lesser degree to corn with wheat suffering collateral damaged as wheat prices have been pulled lower by bearish corn and soybean markets.

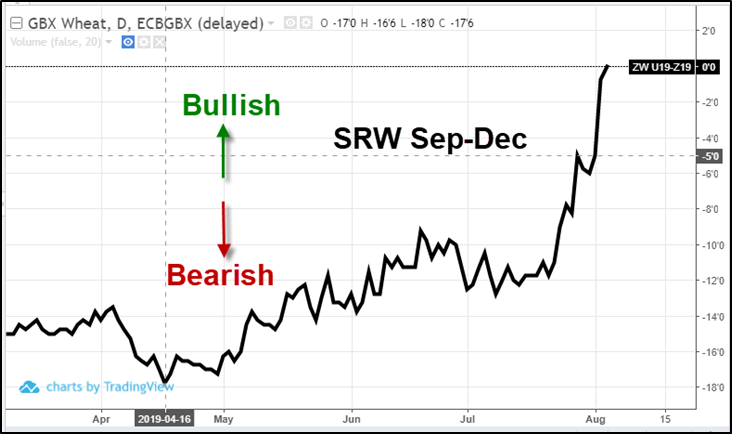

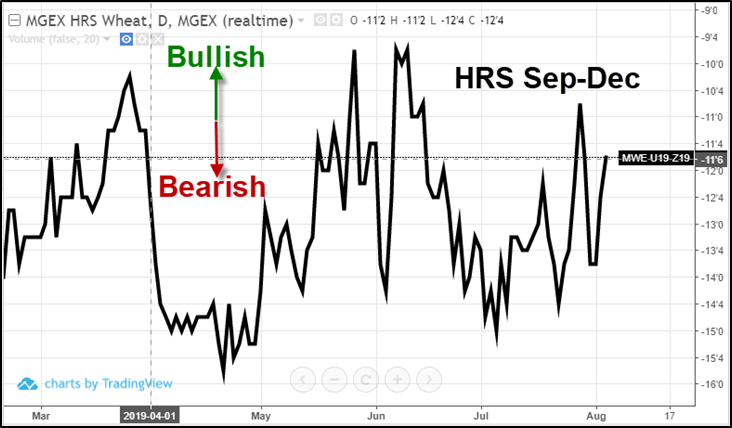

- An excellent way to gauge the commercial user market sentiment—arguably a more accurate “behind the scenes” measure than fund positions—is to observe the cost-of-carry. Cost-of-carry reflects the degree to which the market wants to pay to store a crop, or not.

- High carry indicates adequate supply and a willingness to pay storage costs. Conversely, low carry reflects perceived tight supply and a desire to pull the product into the supply pipeline versus paying for storage.

- Given that, we can see the tale of two very different wheat markets in the carry-spread charts below. The first is the Sep-Dec carry spread chart for SRW wheat that has been trending sharply bullish recently and now has a very bullish carry of only 4% of “full carry.” On the other hand, the HRS Sep-Dec spread chart is a choppy sideways market that suggests a degree of neutrality and non-concern. And indeed, the HRS Sep-Dec carry is near 50% of “full carry,” which is neutral to slightly bearish.

Bottom line, the spring wheat market exhibits bearish sentiment from a variety of perspectives. While adverse weather has resulted in a delayed harvest this year—likely to begin by mid-August—once harvest does begin it will provide further bearish pressure on both futures and basis levels, offering excellent opportunity to extend coverage.