Last month we published “A Case for a Developing Bullish Edible Oil Market.” Market developments since that time have added support to that outlook.

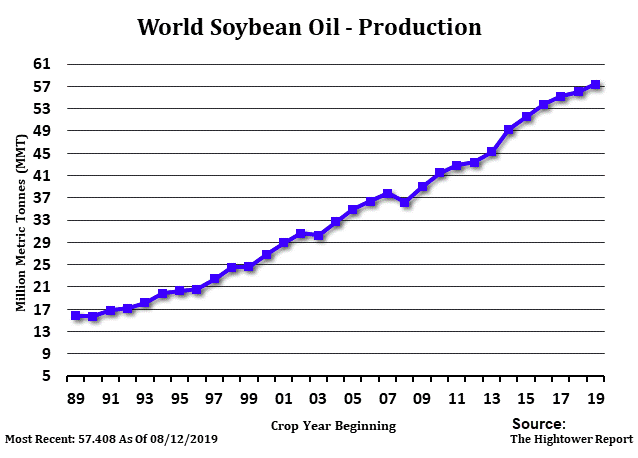

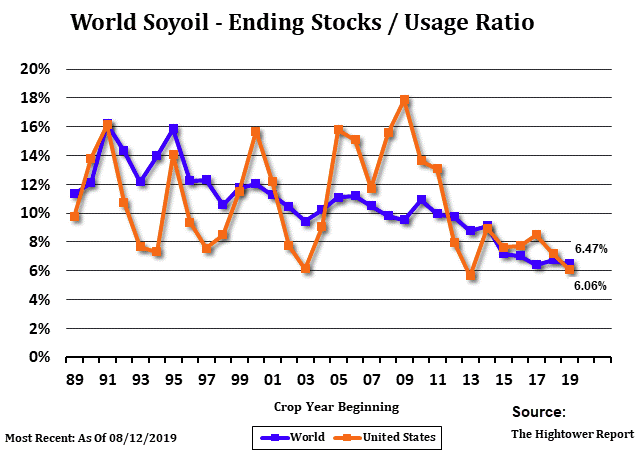

In mid-July we noted the steady decline over recent years in usage ratios— domestically and globally—for soybean oil, palm oil and global edible oils in general. Moreover, the usage ratios have dropped against steadily increasing production; i.e., demand has outpaced higher production for an extended period.

The latest USDA 2019/20 global oilseed outlook painted a bullish picture that included lower production, trade, and stocks compared to last month:

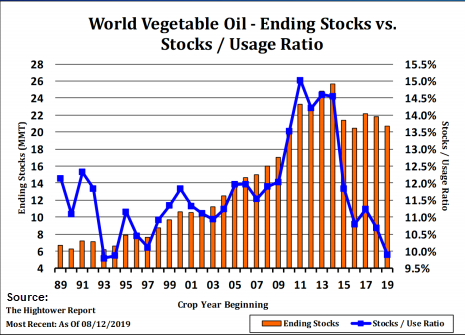

- Global oilseed production was forecast 3.6% less than 2018/19. The net effect was global oilseed ending stocks projected 11% less than 2018/19. The world vegetable oil usage ratio is forecast to fall below 10% for the first time since 1994 (see chart below).

- Soybean production was projected down 5.8% y/y on reductions in the United States, India, and the European Union while world soybean oil usage was projected 2.7% higher with ending stocks forecast dropping 5.5 percent.

- Reductions were forecast for rapeseed, peanut, and cottonseed. EU rapeseed was reduced on lower area and yield for France and Germany. Germany’s rapeseed crop is expected to be down nearly 24%, and the smallest in 22 years. Germany is the second largest producer of rapeseed in the EU.

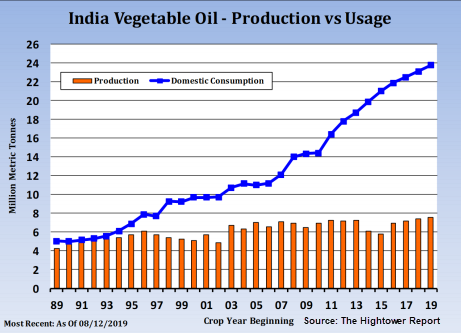

- India’s soybean and groundnut harvested area was reduced. Soybean production in India could fall 6.6%. This created an outlook for record edible oil imports to an estimated increase of 7.3% y/y. An India oil import increase of that magnitude would obviously be bullish for palm oil prices and, by extension, other edible oils. The steady rise in consumption vs. production illustrated in the chart below clearly expresses the impact of an oilseed production decline in India.

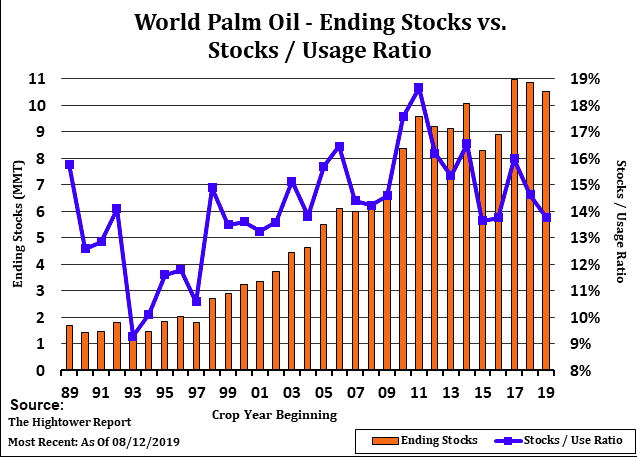

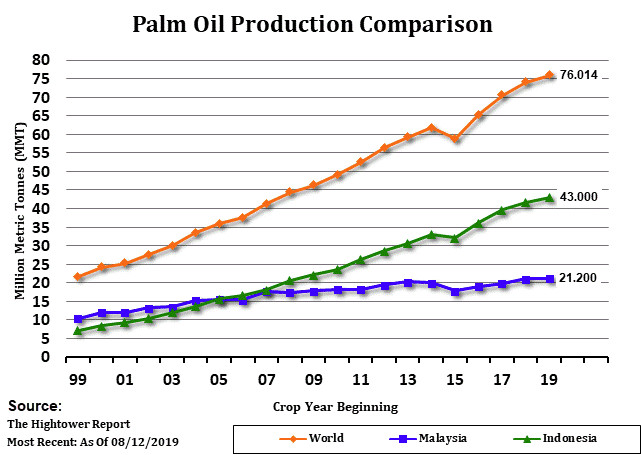

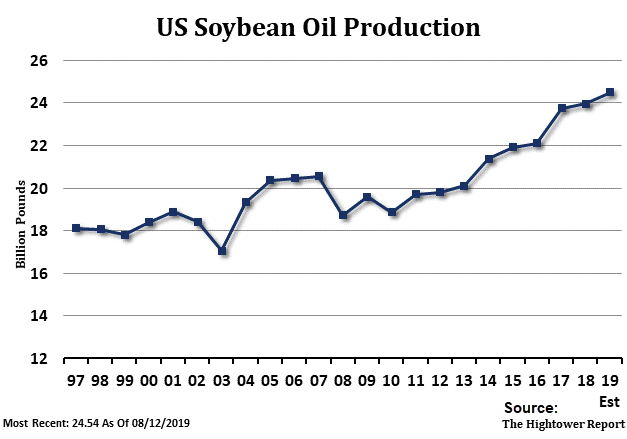

- Thomas Mielke editor of Hamburg, Germany-based newsletter Oil World said at a recent conference that “The combination of accelerating consumption for biofuels and food, and a slowdown in growth in palm oil production will keep palm oil prices higher for the rest of this year and in 2020.” He added that Indonesia’s consumption of palm oil for biodiesel will rise by more than 3 mmt this year and even more next year as the mandatory level of bio-content in biodiesel will increase from 20% to 30%. The two charts below show shrinking usage ratios against rising production over the past three years.

- One bearish/bright spot was sunflower seed production in Ukraine, which is expected to rise y/y.

Regarding domestic soybean oil, following several months of consecutive US record crush levels, June’s USDA crush was down for the fifth consecutive m/m and y/y decline and was the largest downward deviation from the previous year since the USDA resumed the monthly crush data reports in 2015 (a 21 month low).

The just published NOPA July crush report, however, showed a rebound in NOPA’s July crush level, surging from a 21-month low in June to the sixth-highest for any month on record and the highest-ever for the month and the largest monthly crush since March. However, pertinent to our concern of edible oils, while soybean oil production was up 13.5% m/m and 2.2% y/y, stocks dropped by more than expected to a 20-month low of 1.467 billion pounds, down 4.5% m/m and 16.8% lower y/y—substantiating our previous point that demand is outpacing higher production.

Richard Feltes at RJO recently wrote that additional demand concern is mounting from the declining PRC crush that will increase China’s need for imported edible oils. Supporting that notion, the PRC just removed TRQ’s (tariff rate quotas) on soy/rape/palm oil.

The three charts below confirm domestic and world soybean oil usage ratios falling as both world and domestic production steadily increased over those years. The domestic usage ratio is at a seven-year low and the global usage ratio is at low dating back to 1989.

Markets appear to have taken notice after several months of sideways and falling prices. Soy oil futures just reached the highest level since mid-April—taking out the 20/50/100/200 DMAs. Palm oil futures have climbed to a four-month high.

Last month, we said declining/smaller-than-expected crush levels undermined the notion that the US crush would remain large enough to preclude soy oil tightness in an environment of strong SBO demand. However, the July NOPA report echoed the larger and long-term point that stocks and are still experiencing sharp declines as production rises.

Sources: USDA, NOPA, DTN, Reuters, Hightower Reports, RJ O’Brien

Author: Dennis Collins, Director at Trilateral Inc., providing advisory services for commodity and ingredient procurement and risk management.