January Soybean Futures Continue to Climb

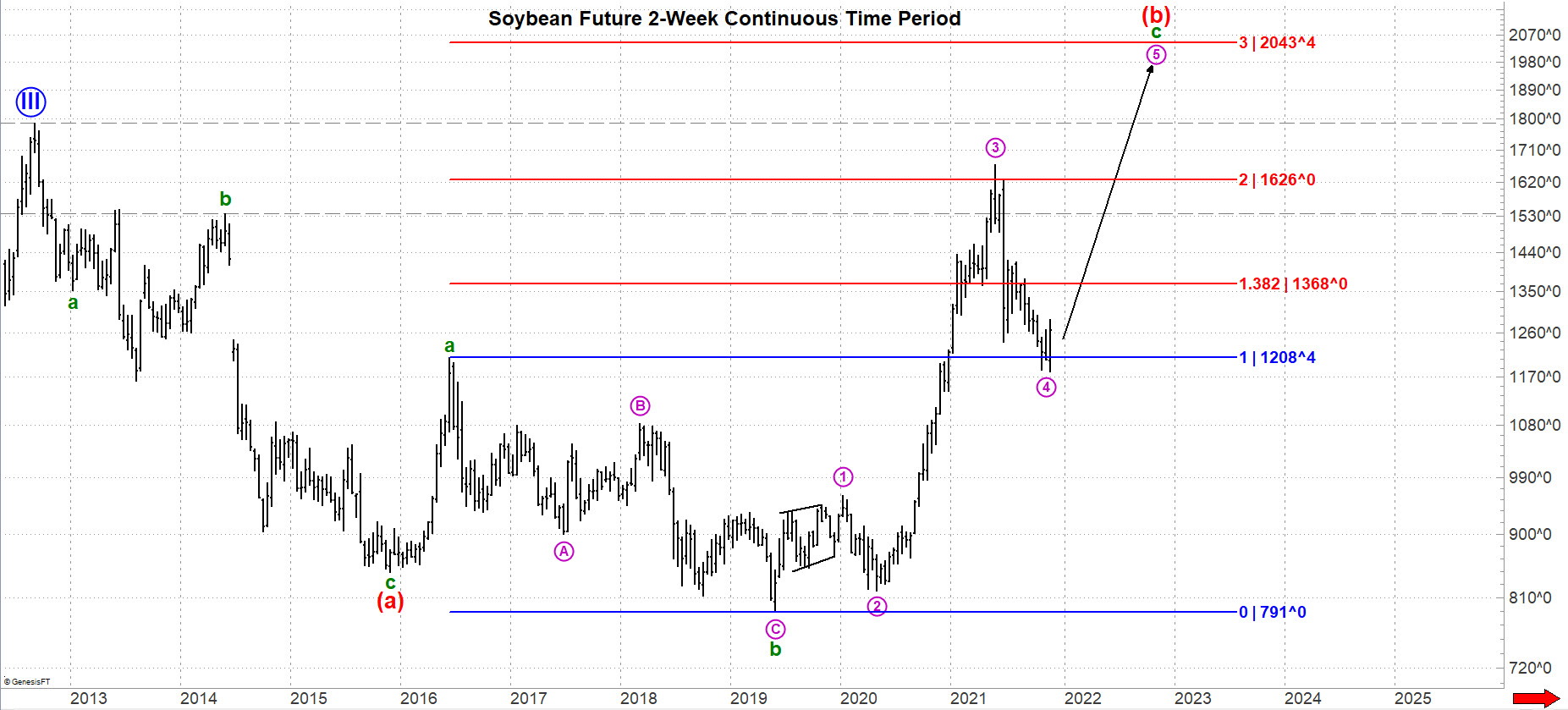

Despite today’s lower close, the rally in January soybean futures remains well intact. The January contract has closed higher in six of its last eight sessions, and trendlines have been broken. Moreover, the latest CFTC Commitments of Traders data reported that non-commercial traders held a 16,438 net short position, so the buying spree will likely continue.

The Role of Soybean Meal and Soybean Oil

January soybean futures have rallied more than $1.00 per bushel off their lows set earlier this month, yet crush margins remain resolute. On Tuesday, the January crush spread traded to a high of $2.06 per bushel. The strong crush margins on both sides of the Pacific Ocean should also encourage further Chinese purchasing of available U.S. soybeans before the Brazilian crop begins to play a factor.

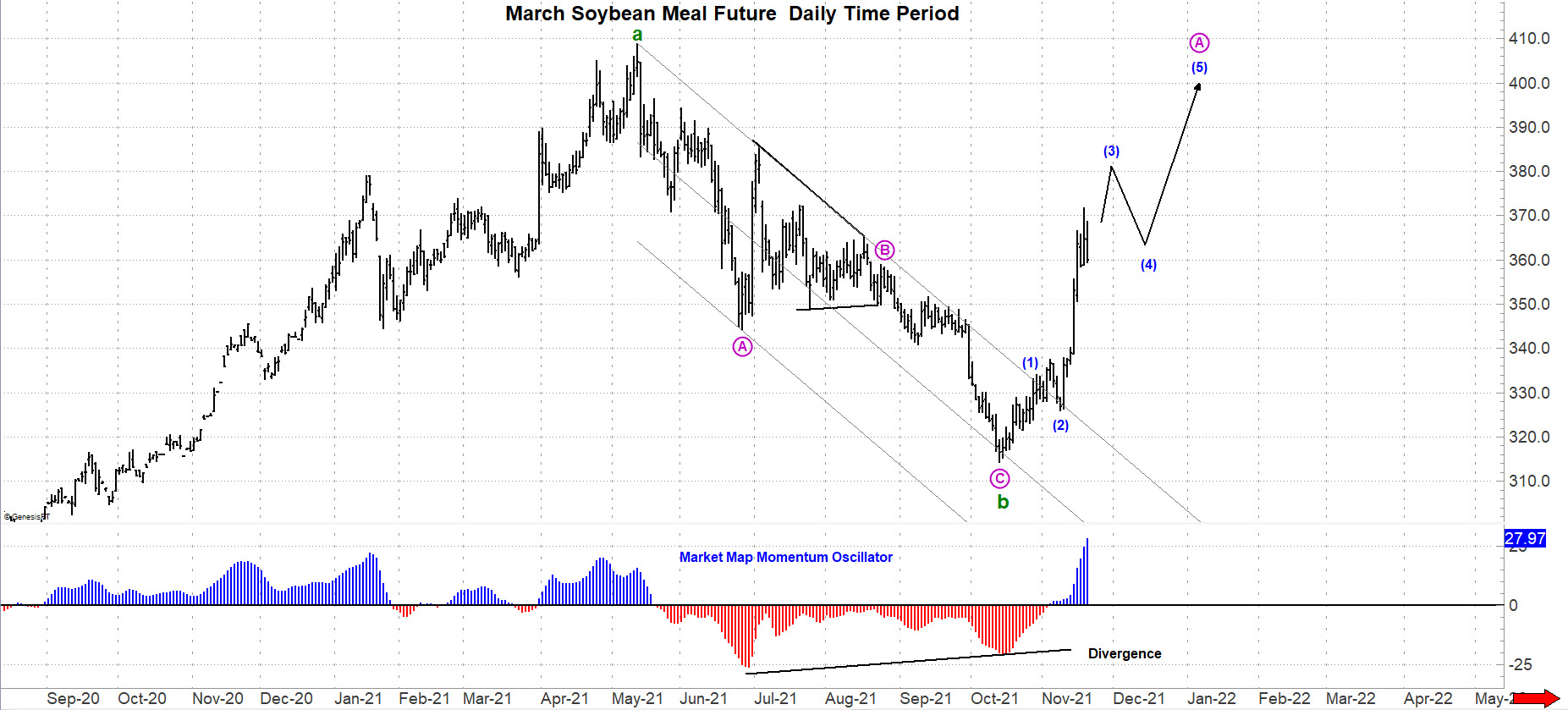

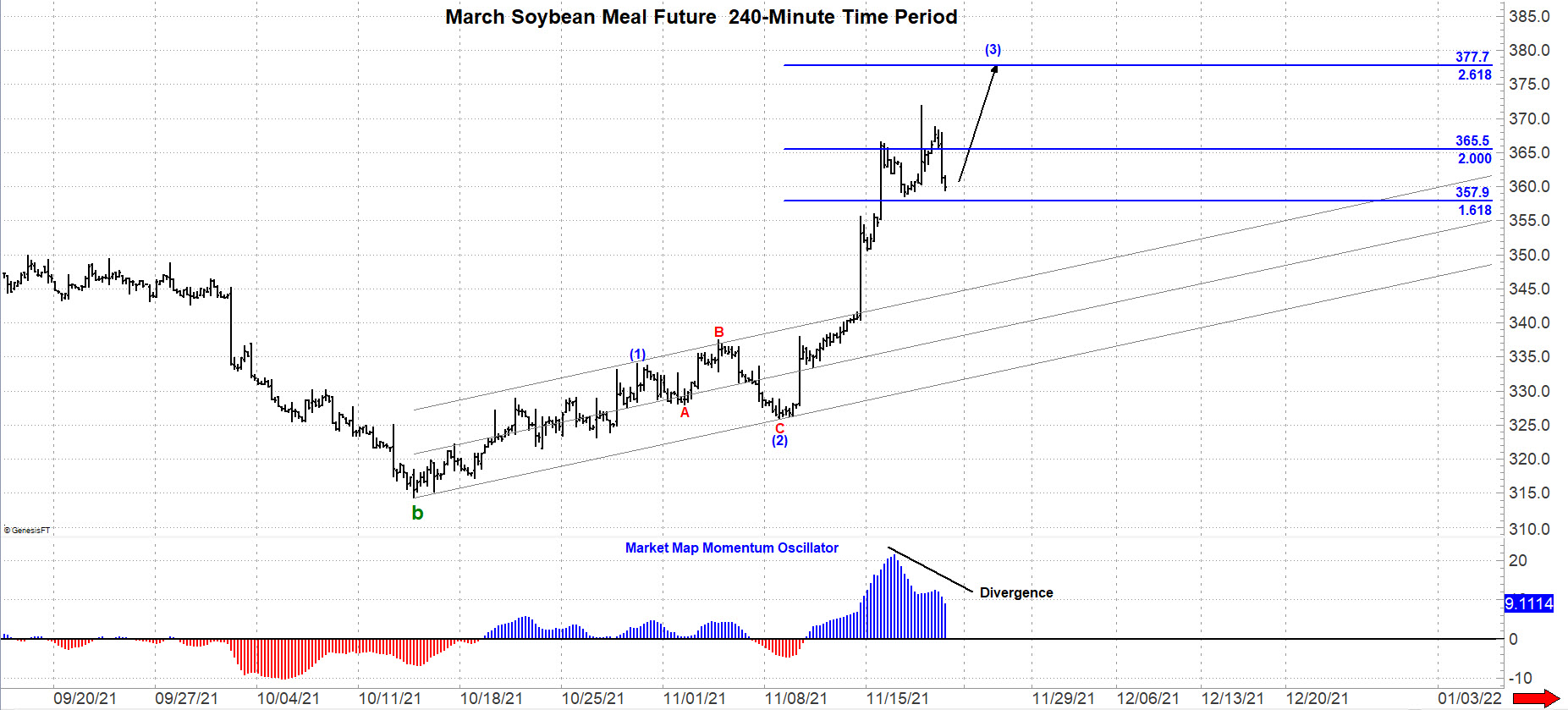

The proverbial script has been flipped with soybean oil being the laggard of the soybean complex. Soybean meal had been the weaker leg of the soybean complex for much of the past year, but its bullish run over the course of the last month has brought it to the forefront, and the rally is not expected to taper off anytime soon.