This post is a follow up from our October 13th post – December Live Cattle.

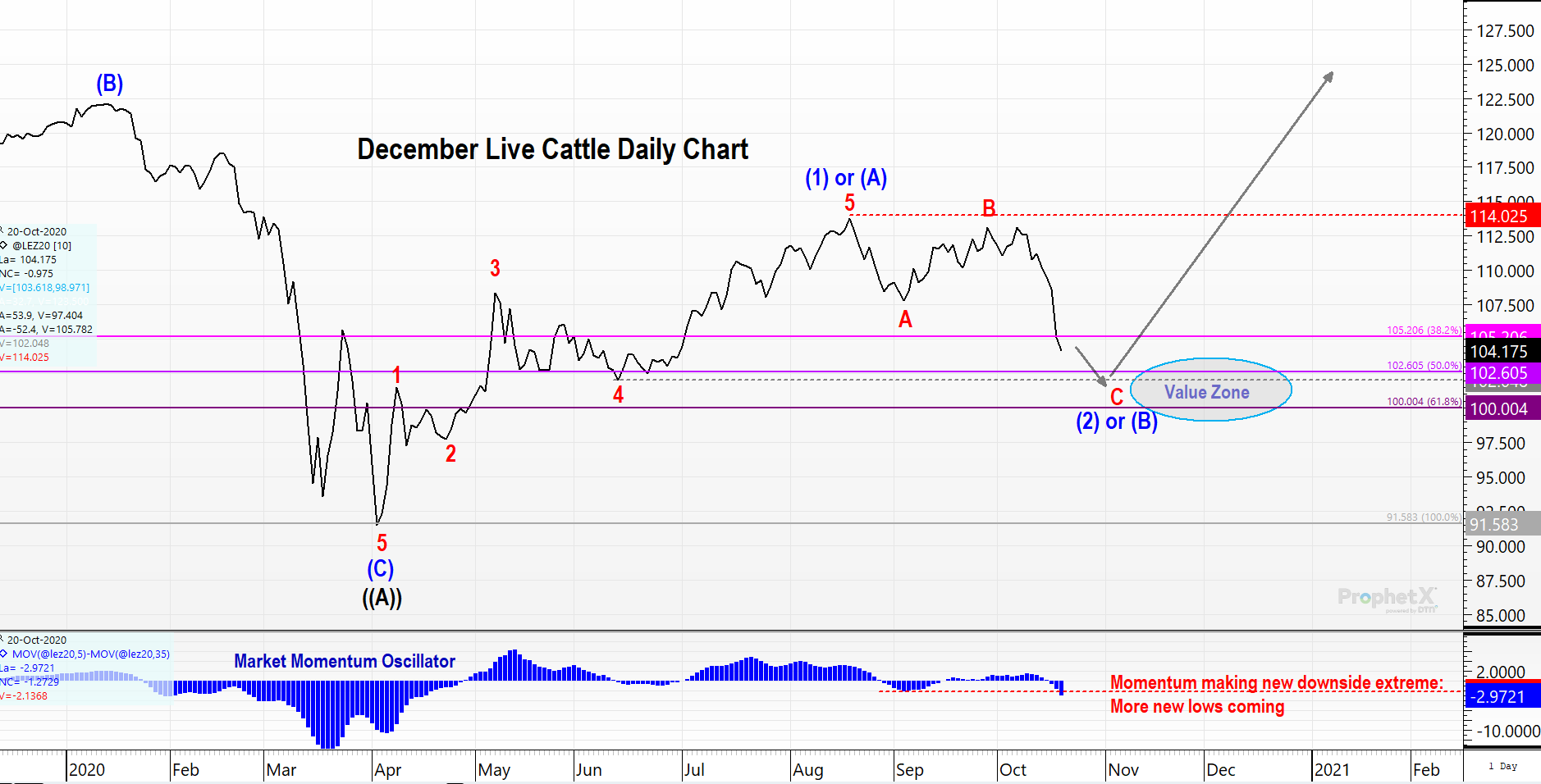

After a small testing of patience (by not breaking any rules), the live cattle futures market is abiding by our Elliott wave forecast. Prices have accelerated lower, as expected. After carving out the suggested top in previous posts, price action has mapped out a clear, initial 5-wave decline in wave A, then countered with a deep retracement in wave B; however, prices never violated the critical resistance for the interpretation ($114.05). Now, we are well into the decline in wave C of (2). Look for prices to target the 102.60-100.20 area. These levels are defined by the common Fibonacci retracements of wave (1) and the Fibonacci multiples of wave A. In addition, the previous fourth wave of one lesser degree terminated near $102.05, increasing the probability that prices will fall to the 50% retracement level ($102.60 on a close only chart). If/When this occurs, it will be an excellent opportunity to add long coverage to a position. See value zone.

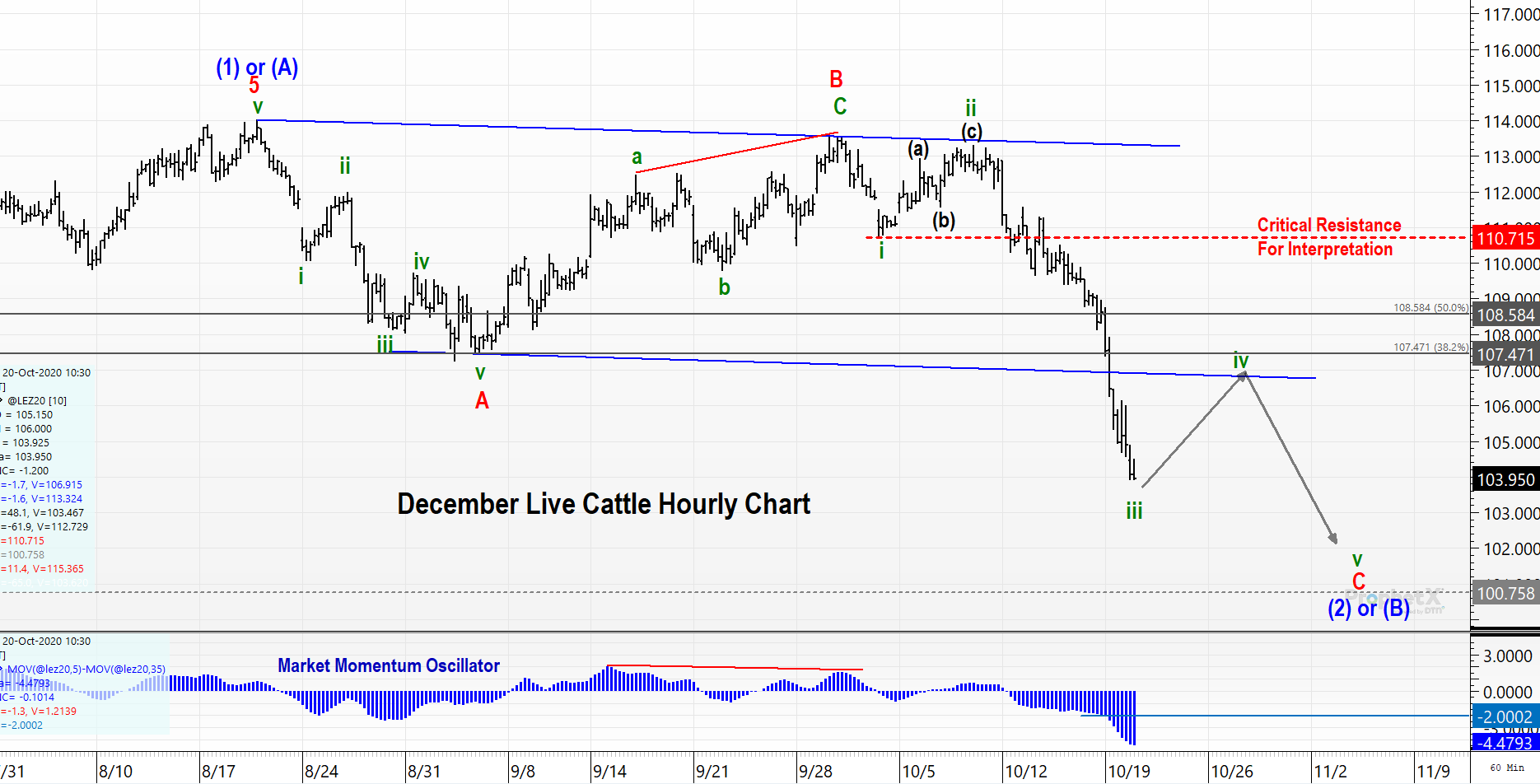

Getting a closer look on the hourly chart, you can see the clear subdivided waves and the expected zig-zag price action. Critical resistance for this interpretation can be lowered (protecting profit from short positions) to 110.65. This is because any wave iv should not enter the price territory of wave i.

This week’s price action has the personality of a wave 3 (greatest ground cover and momentum in shortest amount of time). That implies we can expect more new lows as wave iv higher and wave v lower play out. Increasing momentum on the most recent low supports this outlook as markets typically experience divergence (smaller extremes in momentum with each subsequent price extreme).

Combining The Wave Interpretation With More Widely Used Technical Techniques:

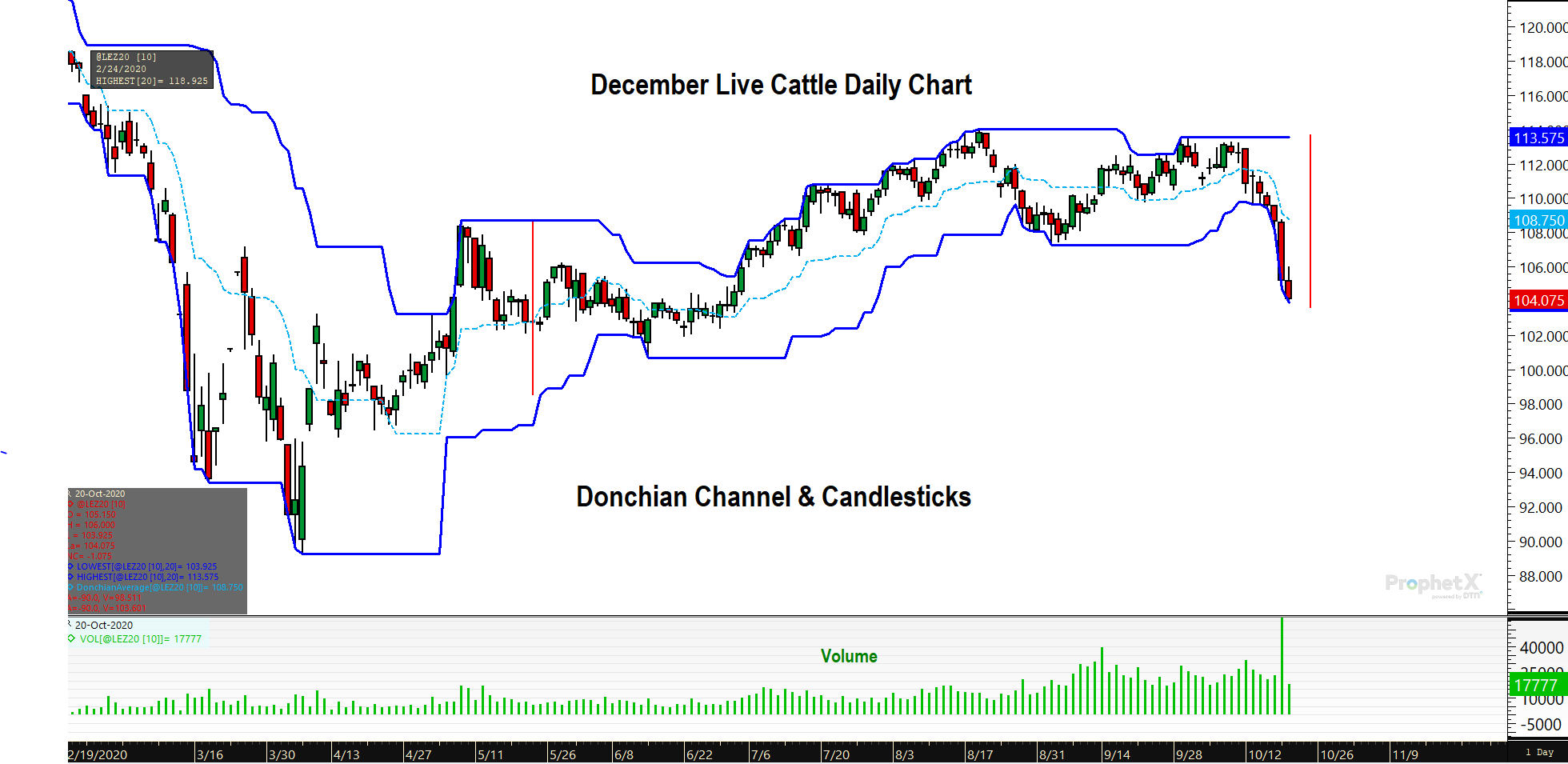

Prices are expanding the channel to the downside. This bolsters our confidence in the forecast. The channel is at its widest point since the pandemic volatility in May. That can imply that a pullback in wave iv is imminent, or we are seeing an accelerated price trend to the downside. In either case, it is good risk-management to layer coverage in the value zone previously presented in our daily chart.

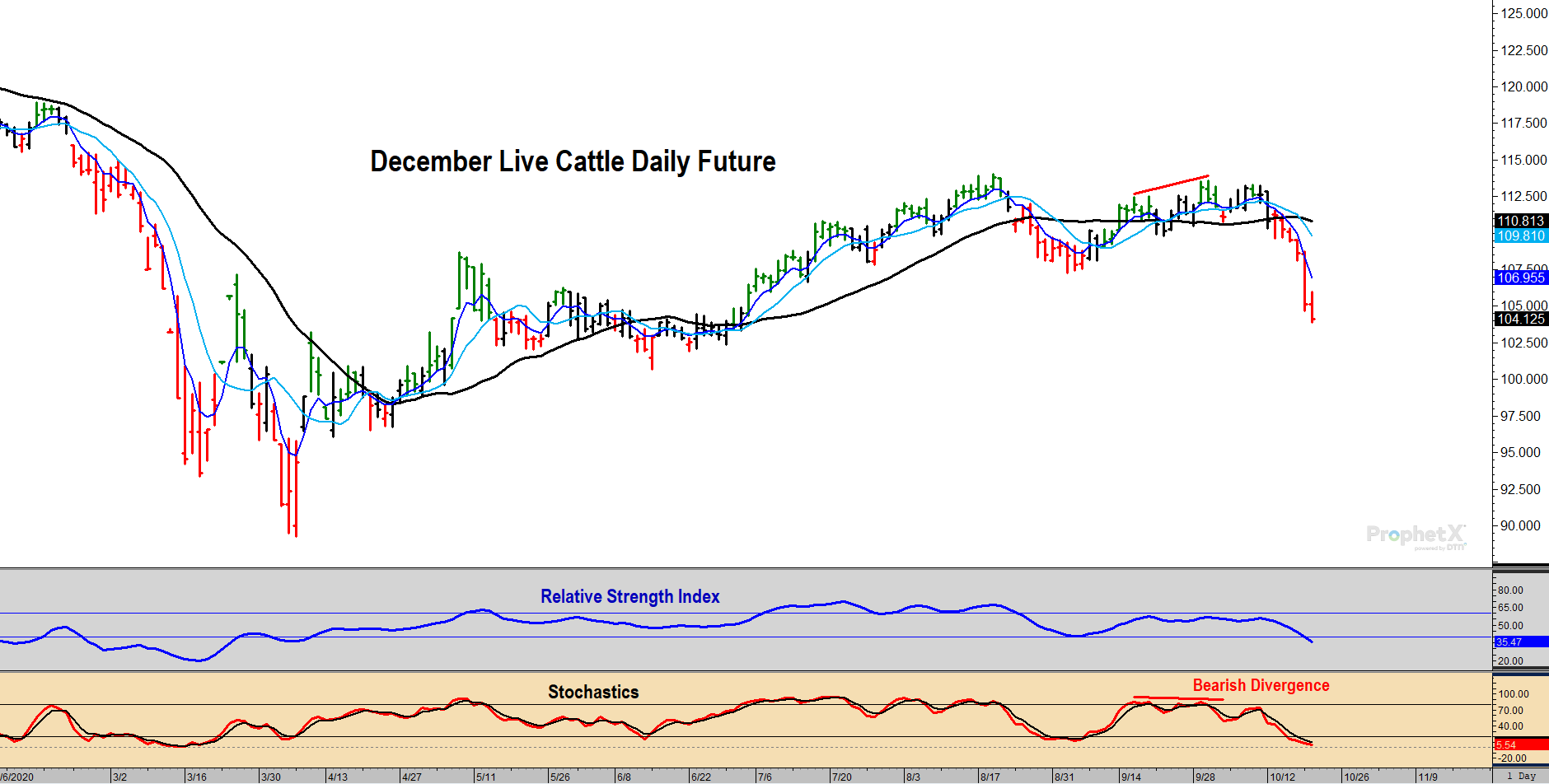

On the price rally in wave B, RSI failed to get above the 60 level, confirming the intermediate downtrend is still intact. Minor bearish divergence in Stochastics with RSI staying below 60 on the counter-trend rally is a nice sell signal. RSI has not breached the 40 level, confirming the immediate downtrend. Stochastics are back in oversold territory, but that can last for some time. At this point, stochastics are showing divergence with the low established back in early September.

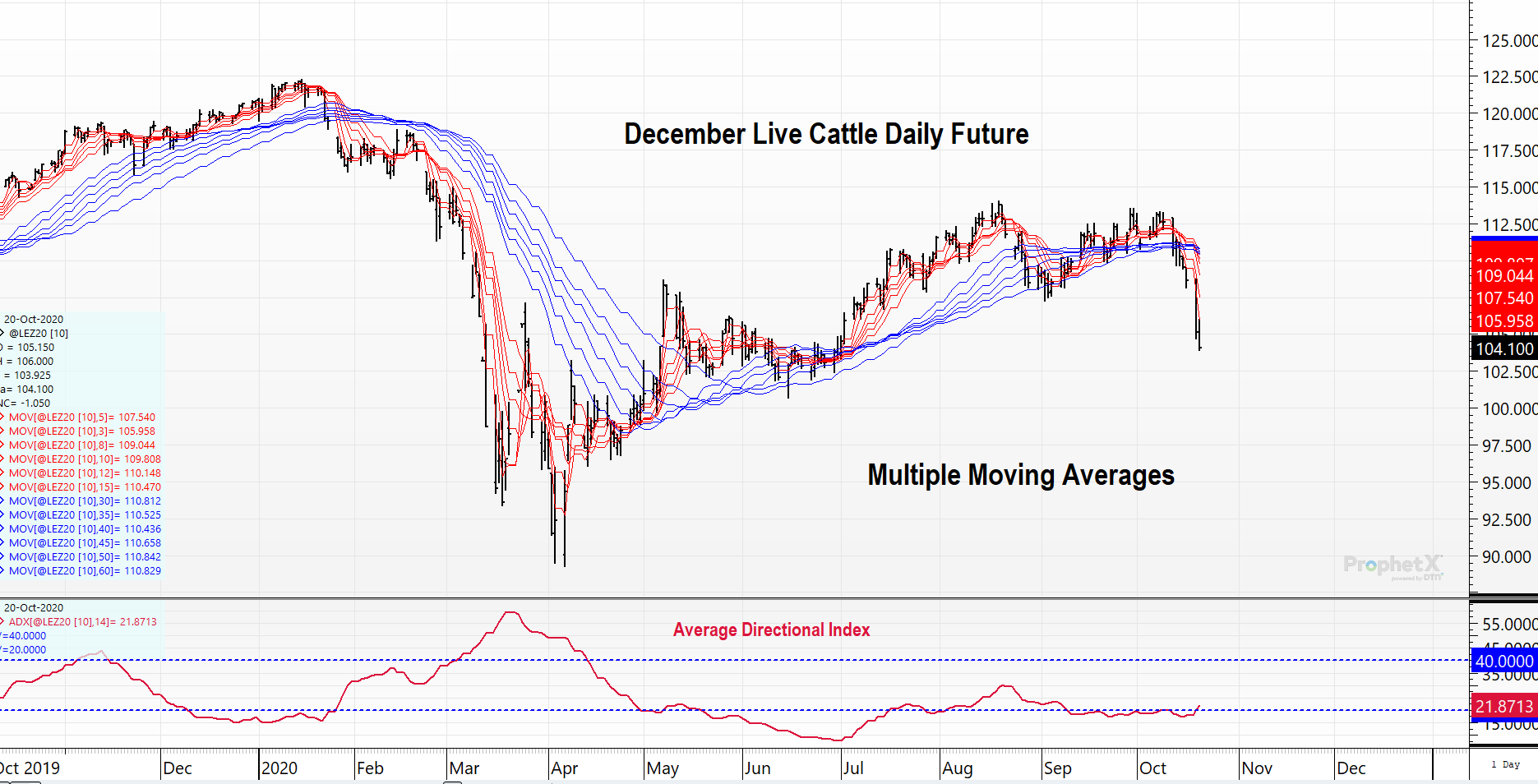

Looking at our multiple moving average chart, you can see that prices have accelerated below all the moving averages (5-day through 60-day) and the shorter-term MA’s are now sloped lower with the long-term ones turning downward. The ADX is resurrecting from dormant territory, suggesting a trend may be developing. If our forecast is correct, prices should chop to a new low with the ADX not picking up any steam. If the ADX picks up and moves above 30 on continued downside price moves, that could be something bigger is happening and may call for a restructuring of the wave count.

Live Cattle Traders’ Perspective:

The market has reward the short positions. With momentum growing, more new lows are expected after price retracements higher. As we get into the value zone areas (100-102), most market participants will start to become very bearish. It is at this time shorts can feel comfortable buying back their positions. Whether to go long will be determined by waiting for an initial 5-wave rally (the safest way to enter a market when knives are falling).

Live Cattle Buyers’ Perspective

Taking the long-term view, our interpretation is that the long-term trend turned higher earlier this year and the longer-term bottom is in place. If/when we get into the value zone, it will be an excellent opportunity to add long coverage because at that point the upside price risk should be much more than the downside price risk. Even if the market moves lower, that will present another great risk-reward opportunity to layer in more coverage. You can afford to get the market wrong, but you cant afford to get risk-management wrong.