Don’t Be The Chicken Looking For The Last Corn Kernel

A great recap of the Corn market’s fundamentals is further below in this post. To get a bigger picture of what is going on in the market, we should look at what the technical chart is telling us. Here is a daily chart of December 2019 Corn futures with a forecast.

Based upon the initial 5-wave move off the low, we can expect with high probability that this market will make another new price high before expiration. This is because the only patterns that start with 5 waves in Elliott Wave Theory are Impulses, Diagonals, and Zigzags. Each of these patterns almost always post a new price extreme in the direction of the trend with the exceptions being truncated wave 5’s for impulses and diagonals, and truncated wave C’s for wave Zigzags. Truncations only occur about 10% of the time giving us a high probability we will see another new high in this market.

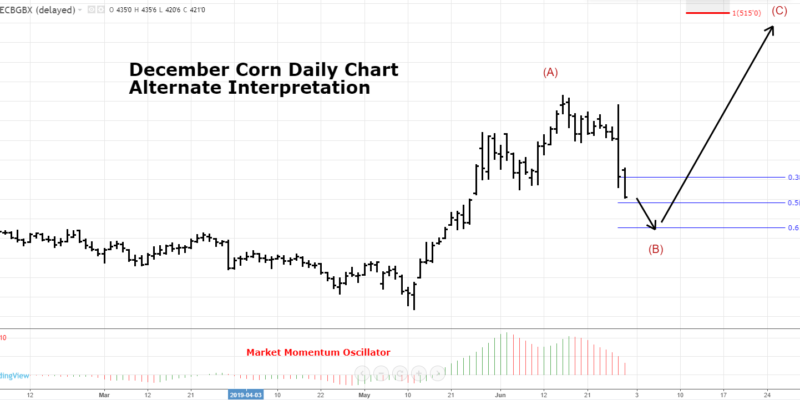

Forecast: Expectations are for some small further decline as wave (C) of 2 plays out before an accelerated wave 3 brings prices much higher. In the event our forecast for a 5-wave impulse wave is incorrect and we are in a Zigzag correction higher (counter-trend move), we should still see a new price high according to the rules and guidelines of Elliott Wave Theory. This alternate interpretation can be seen in a second chart at the bottom of this post.

Assuming our forecast is correct, we would expect wave (C) of 2 move prices a touch lower and target the 38% and 50% retracements of the initial rally. That being said, buyers should not become greedy and wait for additional downside. At current price levels, the market is offering a buying opportunity to layer in 50% coverage at much lower levels that seen mid-June. In the event prices continue lower, a better opportunity exists. If the market adheres to this forecast, you sure will be glad you took 50% of your risk off the table.

Remember the old saying, “it is the chicken that tries to gobble up the last kernel that gets its head chopped off by the farmer”.

Corn Fundamentals

The National Agricultural Statistics Service (NASS) projected U.S. corn acres at a surprising 91.7 million acres (ma) based on an early June survey. That was roughly 4.7 ma higher than the pre-report average trade estimate of 87 ma and just slightly under the lofty 92.8 ma March intentions.

The post-report confusion is as high as we’ve ever seen it with traders not sure what to believe after USDA posted such a large bearish surprise on planted acres. Due to late planting still occurring during the survey period, and the fact USDA will resurvey every major corn producing state, confidence in USDA’s acreage is number is at an all-time low.

With the unprecedented excess water and flooding in the spring, the trade had expected a much more bullish number and managed funds were caught carrying a long of close to 180,000 contracts as of last Tuesday. Funds began to liquidate those longs and sent the market reeling. While just lower again to begin Monday, the bearish acreage estimate was offset a bit by lower-than-expected June 1 corn stocks at 5.2 billion bushels, along with the implied higher usage, and the positive restart of U.S.-China negotiations following a proposed trade truce from President Donald Trump and President Xi Jinping at the G-20 summit in Japan.

Also stopping the bleeding to some extent is the idea that final acres and yield are far from set in stone, with a re-survey by NASS of all corn states in July, and those results likely to show a much different story on the Aug. 12 WASDE report.

At the time of the last survey there were an estimated 15.3 ma left to be planted. Many in the trade assume acreage and yield numbers that will be much lower than those revealed recently.

Weather has taken a turn for the better, with warmer and sunnier weather in all but the northern Midwest and Plains likely to propel crop condition ratings higher Monday.

U.S. corn, even with the late week break, remains priced some 30 to 50 cents per bushel higher than other major exporting countries.