This is a follow-up from the July 28th post with the analyzed futures contract switching from October to December.

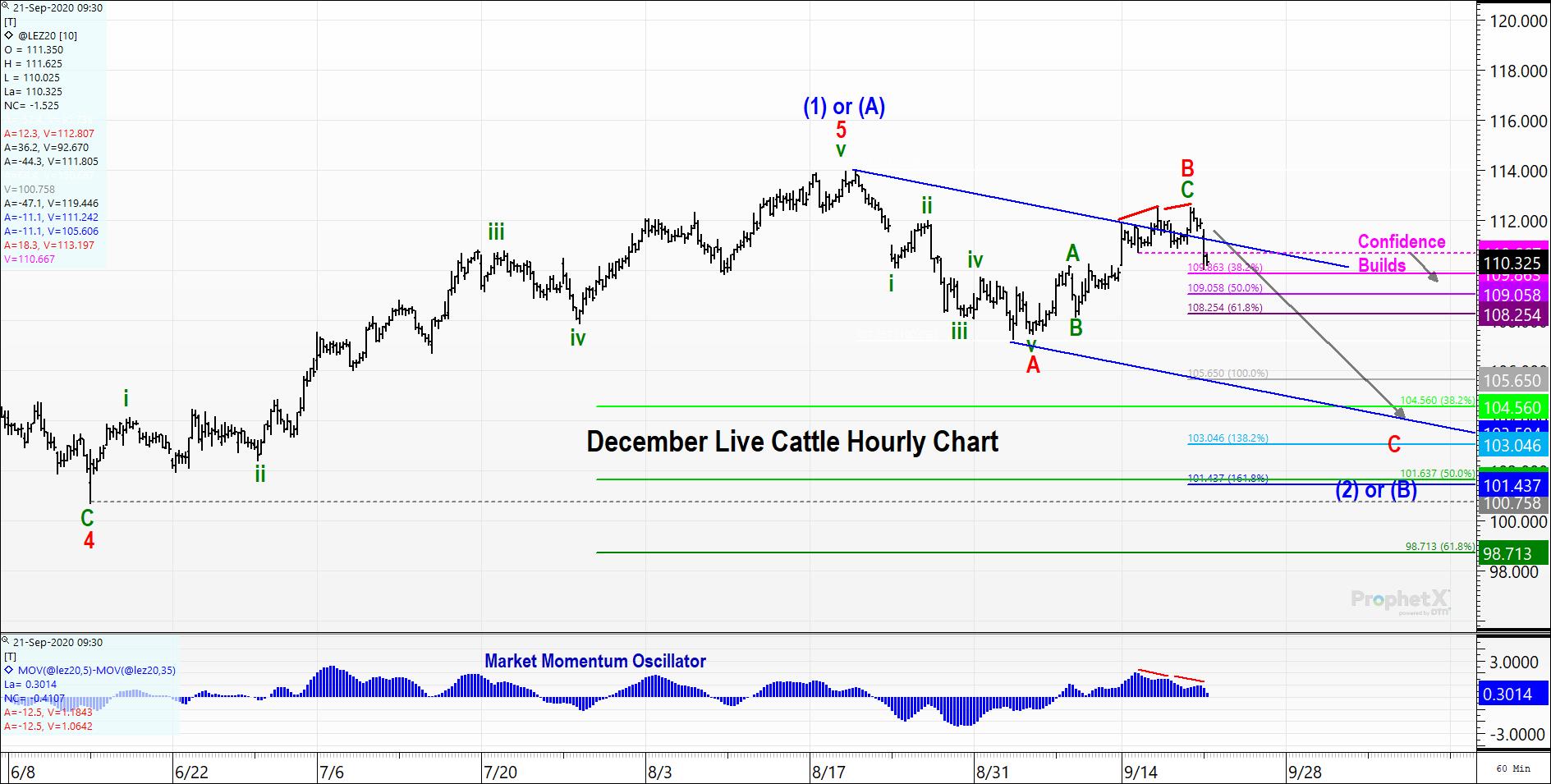

After the carved out top suggested in the previous post, all has gone to plan. Price action has mapped out a clear, initial 5-wave decline in wave A, then countered with a 62% retracement higher in wave B. This has set the stage for another decline in wave C of (2). Look for prices to target the 103.20-105.50 area. These levels are defined by the common Fibonacci retracements of wave (1) and the Fibonacci multiples of wave A. If/When this occurs, it will be an excellent opportunity to add long coverage to a position.

We believe the long-term bottom is in place; however, even if we were wrong, and the previous rally from the bottom was part of an (A)-(B)-(C) correction, we should still see a new price extreme to the upside(in a wave (C)).

Getting a closer look on the hourly chart, you can see the clear subdivision waves and the expected zig-zag price action. As we decline in wave C, it should receive support from the lower boundary line of the price channel. It will be important to analyze slope and momentum to add confidence in stepping into a market that will feel like it is making new lows.

Combining With More Widely Used Technical Techniques

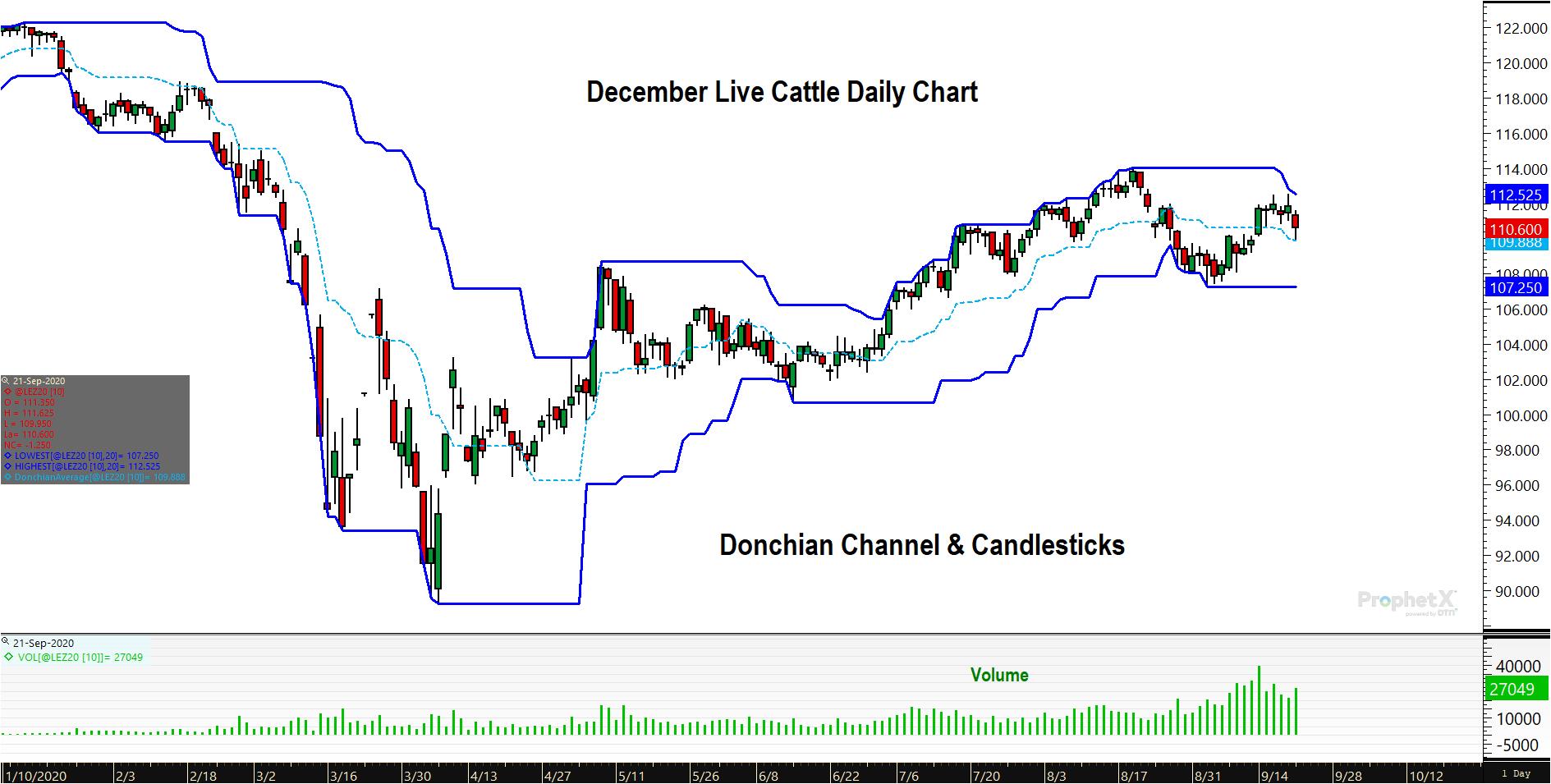

Prices rallied in the upper half of the Donchian channel and then experienced 4 candles that are very small in body length. These candles illustrate lack of conviction in the market and are often found at reversal points (the end of wave B?).

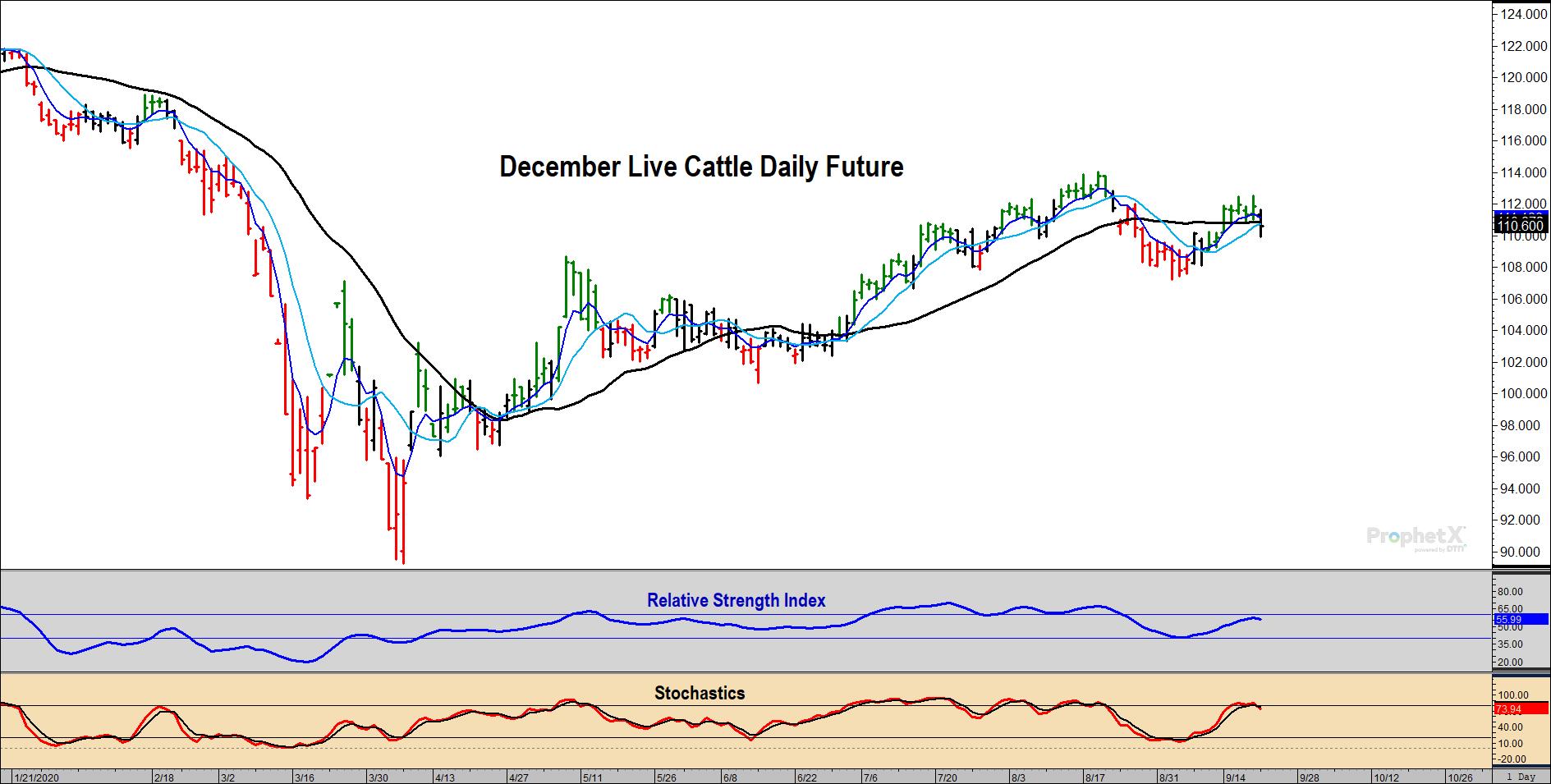

Below, the RSI is rallied right up to that 60 level (bear market resistance), as expected. Stochastics have gone into oversold territory and returned. This combination works as a great sell signal in commodity markets, adding confidence that wave C is beginning.

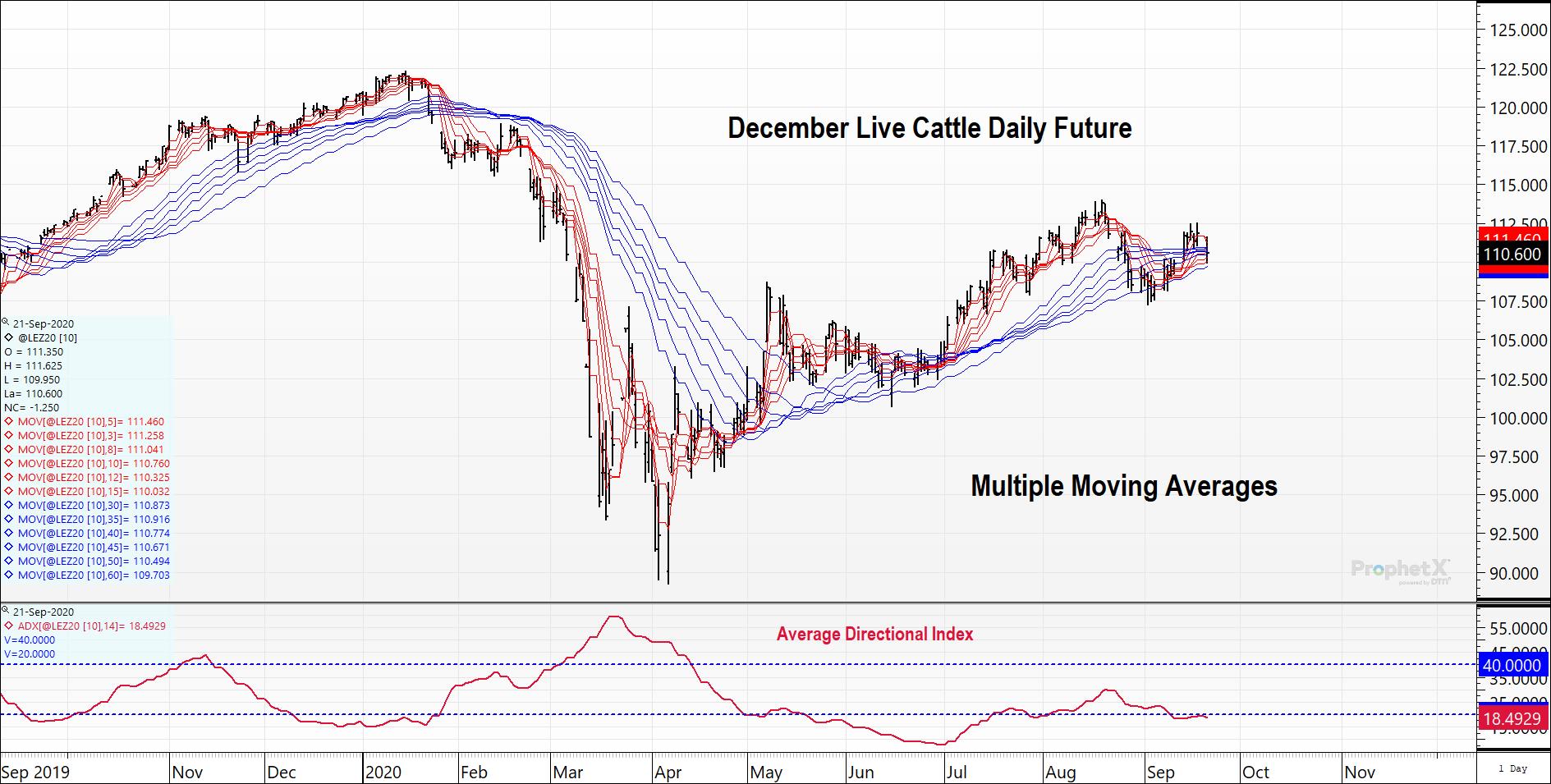

Looking at our multiple moving average chart, you can see that prices are above most moving averages. The slopes of the averages are upward, but they are also converging, offering mixed signals. ADX is back in dormant territory, suggesting moving average trading systems are less reliable.

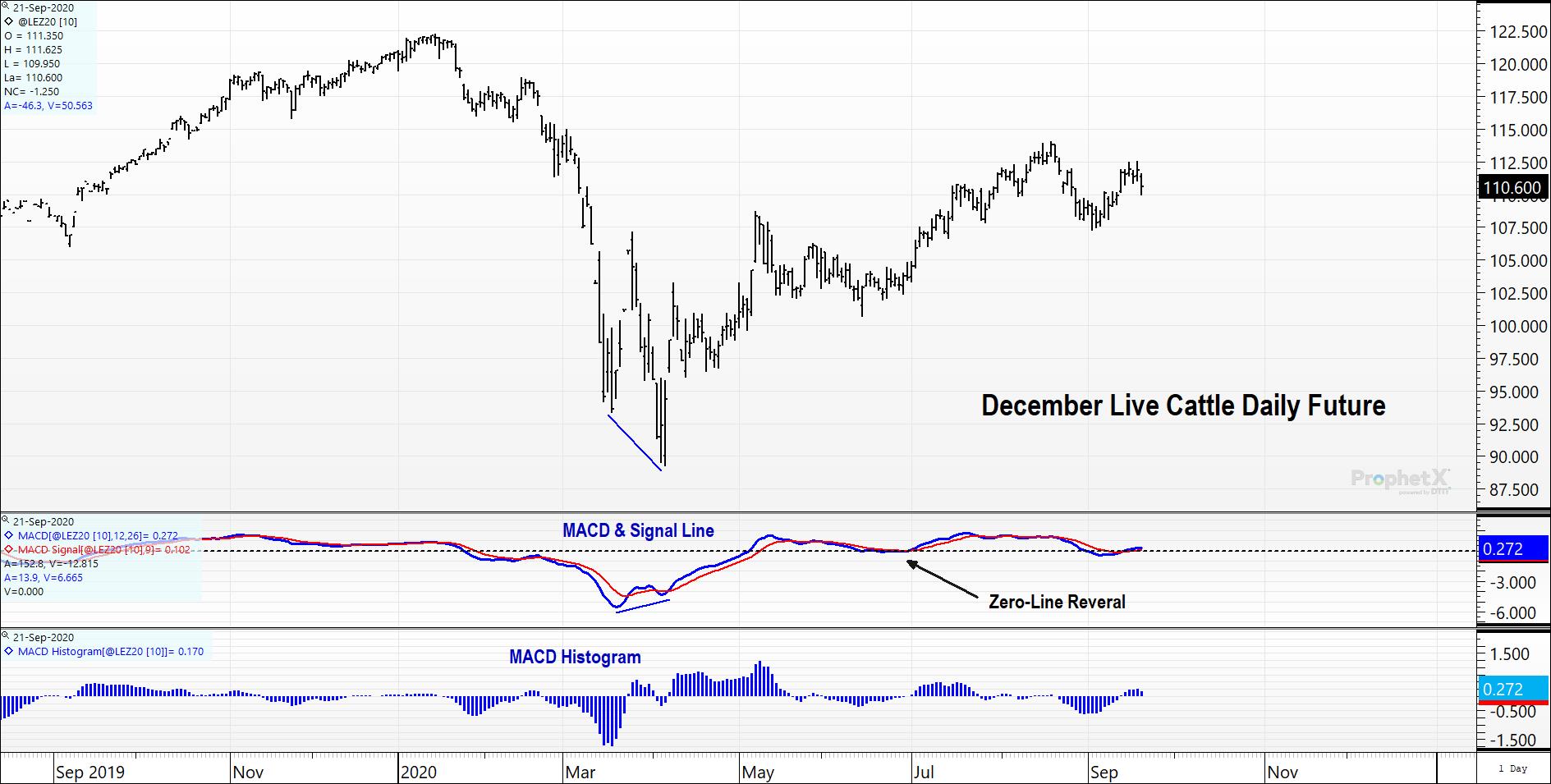

Studying the MACD and Signal lines, they have moved below the zero line and stabilized. Without an immediate reversal, a bearish stance should gain confidence.

Traders’ Perspective: The market is giving signals to be short this market. The risk-reward favors being short in the immediate term. A stop-loss could be place on a closing price above the previous swing high. Weighing that against the mid-range of our downside targets, you can see a better than 3:1 reward:risk ratio.

Buyers’ Perspective: Taking the long-term view, our interpretation is the bottom is in place. If/when we get a price retracement back to the 103-105 area in wave C, and momentum is waning, it will be an excellent opportunity to add long coverage.